Experience the Power of Productivity

Make your team 40% more efficient. Set up your account in just 2 minutes!

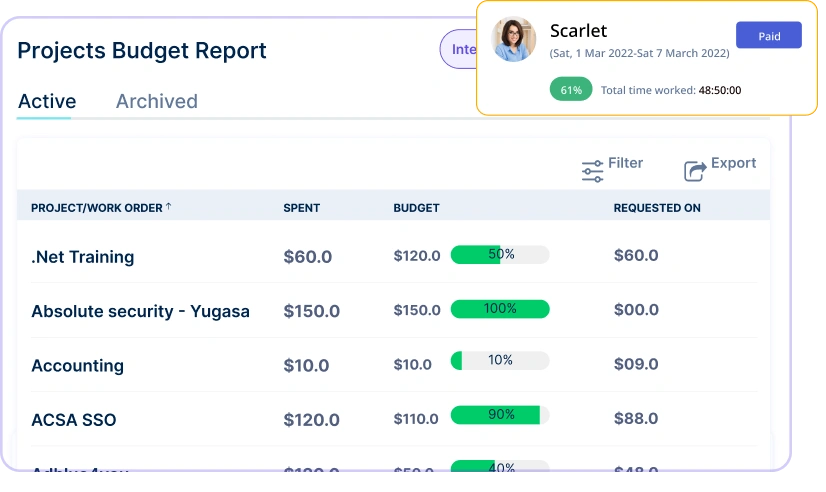

Streamline your budget allocation process with our automated solutions, ensuring optimal resource distribution for maximum impact.

Stay on top of your finances with powerful budget-tracking tools. Gain clear insights into your spending habits and achieve your financial goals with ease.

Active users

Hours Tracked

Efficiently manage and distribute resources to ensure optimal project performance while staying within budget.

Adapt resource allocation dynamically throughout the project lifecycle to maximize efficiency and control costs

Stay within financial targets while managing budget strategically to maximize project value.

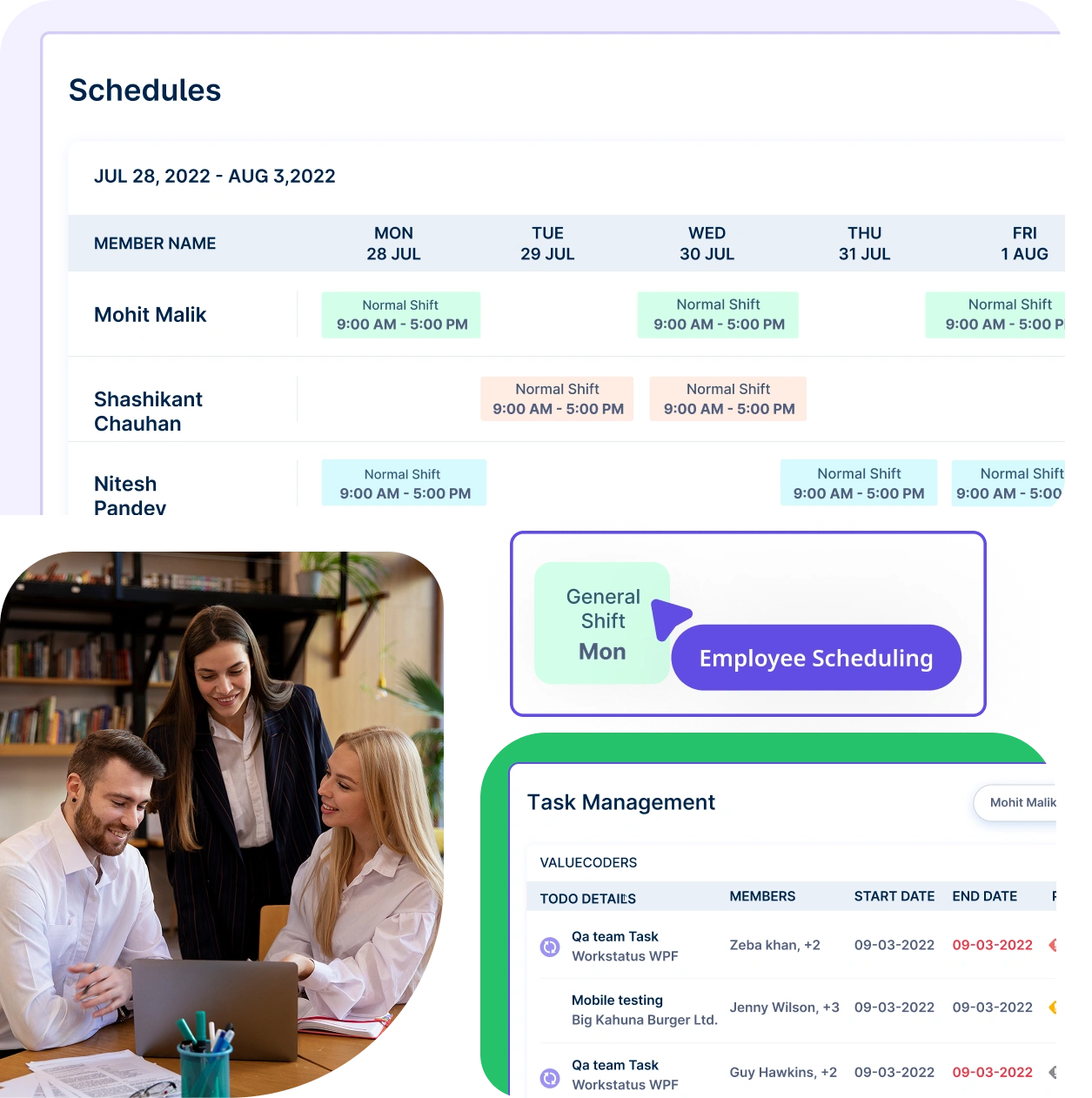

Balance projects across your team to prevent burnout and boost efficiency. Proper budget management keeps projects on schedule and teams working effectively.

Ensure projects stay on budget and on track with fair task distribution, real-time progress monitoring, and proactive bottleneck identification.

Stay on top of project timelines by tracking task progress and identifying expense bottlenecks early.

A multi-national marketing firm, boosted overall efficiency.

Increase Your Team Productivity

A Delhi-based startup achieved 30%+ increased ROI with Workstatus.

Enhance Your Business ROIMaximize the value of your workforce by aligning employee skills and availability with project demands, leading to improved productivity and enhanced cost control.

Utilize your employees’ skillsets and availability in the most cost-effective manner possible to meet project needs and stay within budget.

Maintain project momentum and control costs by fostering a flexible workforce capable of adapting to changing project demands and priorities.

Monitor project budgets in real-time, control expenses, and ensure financial accuracy to keep your team on track and within limits.

Gain full visibility into project costs and optimize resource allocation with real-time budget insights.

Work together effortlessly, no matter where your team is located, with tools that keep communication and collaboration smooth.

Stay connected and accountable

Balance productivity everywhere

Empower field team efficiency

Optimize office productivity

From IT to healthcare, retail to manufacturing, Workstatus adapts to meet your industry’s unique needs.

We provide clarity, no matter the industry, by showing you:

Analyze and assess tools side by side to choose the best fit for your team’s needs and goals.

From time tracking to advanced analytics, Workstatus has everything your business needs to elevate operations.

A budget tracking system is essential for maintaining financial control in project budgeting. The ideal solution should include real-time budget monitoring, allowing businesses to track expenses as they occur. A budget expense tracker categorizes costs, ensuring that every dollar is accounted for. Additionally, customizable budget tracking templates help standardize reporting, reducing manual entry errors and increasing efficiency. Integration with Gantt charts and task management tools ensures that budgets align with project milestones, preventing cost overruns.

Advanced reporting & analytics features provide comprehensive insights into spending patterns, enabling informed financial decisions. Businesses should also prioritize benchmark & goals tracking, allowing them to compare actual expenses against planned budgets. Workforce analytics and payroll management features ensure that labor costs are accurately allocated to each project. Moreover, compliance reporting is crucial for meeting regulatory requirements and maintaining transparency in financial records.

A well-structured budget tracking tool should integrate seamlessly with online invoicing, ensuring that payments, expenses, and revenues align within a single platform. Business owners benefit from automated alerts, ensuring they stay within budget limits while optimizing resources. Ultimately, a business budget tracking system with these features helps organizations streamline financial workflows and maintain profitability.

A budget tracking tool enhances financial visibility by providing real-time insights into income, expenses, and budget allocations. Business budget tracking becomes seamless with centralized financial data, allowing companies to monitor cash flow across different projects and departments. The system organizes financial records into a structured budget tracking sheet, eliminating the risk of discrepancies caused by manual data entry.

One of the most significant advantages is automated reporting & analytics, which generates instant financial reports, making it easier for business owners to assess financial performance. A robust budget expense tracker helps categorize expenses, ensuring that every transaction is accurately recorded. Additionally, businesses can set spending limits and compare financial performance against benchmarks & goals to stay aligned with long-term objectives.

The integration of workforce analytics and payroll management provides a comprehensive view of labor costs, preventing overspending on salaries and benefits. Compliance reporting ensures that businesses meet regulatory standards, simplifying audits and tax filings. Furthermore, by syncing with online invoicing, a budget tracking system enables automated expense tracking, improving financial transparency. Overall, businesses that adopt a structured budget tracking template can enhance financial decision-making and optimize resource allocation efficiently.

A budget tracking software plays a vital role in project budgeting by automating expense allocation and monitoring financial performance. By leveraging a budget expense tracker, businesses can allocate funds to specific tasks, ensuring that project costs remain under control. The system integrates with Gantt charts and a task management tool, providing a real-time financial snapshot of each project phase.

One of the primary benefits is the ability to use a budget tracking template, which simplifies data entry and maintains consistency in financial reporting. Automated alerts notify teams when spending approaches predefined thresholds, preventing budget overruns. Additionally, reporting & analytics capabilities provide actionable insights, allowing business owners to track financial efficiency across multiple projects.

A business budget tracking system also integrates payroll management and workforce analytics, enabling companies to allocate labor costs accurately. This helps prevent overspending on wages and ensures that employee time is billed correctly. Furthermore, compliance reporting ensures that all financial records meet industry regulations. By linking the budget tracking system with online invoicing, businesses can streamline payments and cash flow management. Ultimately, an automated budget tracking tool enhances financial efficiency and workload management, reducing administrative workload while maintaining strict control over project expenditures.

Effective budget tracking software plays a crucial role in payroll management and workforce analytics by providing financial clarity and ensuring proper allocation of labor costs. A well-structured budget tracking system helps businesses monitor payroll expenses in real-time, ensuring that wages, benefits, and overtime payments remain within budget. This is particularly important for business owners who need to balance labor costs with revenue generation.

A budget tracking sheet categorizes payroll expenses, allowing businesses to analyze workforce spending against benchmark & goals. The integration of workforce analytics provides insights into employee productivity and helps managers make data-driven decisions regarding staffing levels. Additionally, an advanced budget tracking tool helps forecast future payroll expenditures, reducing the risk of financial shortfalls.

By incorporating compliance reporting, businesses can ensure that payroll processes adhere to tax regulations and labor laws. This minimizes the risk of legal penalties while maintaining accurate records for audits. When integrated with online invoicing, payroll costs can be factored directly into financial reports, ensuring seamless budgeting. Ultimately, a business budget tracking system that includes payroll insights helps organizations manage labor costs efficiently while maintaining compliance and financial stability.

A budget tracking template is a valuable tool for businesses aiming to streamline compliance reporting and maintain audit readiness. It standardizes financial records, ensuring consistency and reducing errors caused by manual entry. A well-structured budget tracking sheet categorizes expenses, helping businesses track every financial transaction with precision.

One of the main benefits of using a budget tracking system is that it automatically compiles necessary data for audits. It integrates with reporting & analytics tools, allowing business owners to generate detailed financial statements instantly. Additionally, compliance reporting features ensure that all transactions adhere to regulatory requirements, minimizing legal risks.

By leveraging a budget expense tracker, businesses can track tax-deductible expenses and maintain an organized record for tax filings. The ability to compare actual expenditures against benchmarks & goals provides transparency, making financial assessments more accurate. Integration with payroll management ensures that employee compensation is correctly accounted for within budgets.

A business budget tracking solution that includes online invoicing simplifies financial oversight, making audits less stressful. With automated tracking, alerts, and real-time financial monitoring, businesses can proactively address discrepancies before audits occur. Ultimately, a well-designed budget tracking tool enhances financial integrity and regulatory compliance.

A budget tracking tool enhances online invoicing and financial reporting by providing a structured approach to managing income and expenses. In project management, financial oversight is crucial, and a budget tracking system ensures that all expenditures align with predefined project budgets.

By integrating business budget tracking with invoicing, businesses can automate payment tracking, ensuring that revenue flows are accurately recorded. A budget tracking sheet helps break down costs by category, making financial analysis more precise. Additionally, reporting & analytics provide real-time insights into profitability, allowing business owners to make informed decisions.

Using a budget tracking template, companies can compare actual revenue against benchmark & goals, identifying potential shortfalls early. The system also supports compliance reporting, ensuring that all financial records meet auditing standards. When combined with payroll management, labor costs can be accurately reflected in financial reports, providing a comprehensive view of business expenses.

Budget tracking software helps manage and monitor project expenses, ensuring you stay within budget. It provides real-time insights, tracks costs, and generates reports to help you make data-driven decisions.

Look for features like expense tracking, customizable budget templates, real-time reporting & analytics, Gantt charts for project timelines, and integration with payroll management to streamline financial oversight.

Yes, budget tracking systems are designed for managing multiple projects simultaneously. They let you allocate resources, set financial benchmarks, and track goals across various tasks and teams for better project budgeting.

Effective budget tracking enhances project management by providing visibility into spending patterns, benchmarks, and resource allocation. This ensures better task management, forecasting, and compliance reporting, improving overall efficiency.

Yes, while online invoicing helps with billing, a budget expense tracker offers a broader view of expenses, workforce analytics, and cost management. It helps business owners stay on top of both expenses and financial performance.

Many budget tracking tools provide built-in templates and customizable budget tracking sheets. These help you set up financial tracking quickly and align your budgets with reporting & analytics for better decision-making.

Managing your workforce, projects, and reports gets simple & effective.

Managing your workforce, projects, and reports gets simple & effective.

Get detailed and clean activity reports of your team.