Table of Contents

Understanding how the FLSA defines and regulates working hours is essential for both employees and employers to-

- Ensure compliance

- Protect workers’ rights

- Maintain fair and equitable working conditions

This blog will explore the key aspects of working time according to FLSA compliance and shed light on its significance in the modern workplace.

Let’s dive in-

What is Fair Labor Standards Act (FLSA)?

In this section, we will understand the Fair Labor Standards Act (FLSA) in detail.

Federal labor law was enacted in 1938 to establish and regulate labor standards in the United States.

The Wage and Hour Division (WHD) of the U.S. Department of Labor has enforced FLSA.

It has set up the industry guidelines for the following:

- Minimum wage

- Overtime pay

- Child labor

- Recordkeeping requirements

Now, let’s have a look at:

FLSA Compliance

Employers must comply with the FLSA regulations to ensure fair treatment of employees regarding wages and working conditions

Compliance includes adhering to minimum wage rates, overtime pay rules, and other provisions outlined in the law.

FLSA Recordkeeping Requirements

Employers covered by the FLSA must maintain accurate records of

- Working hours

- Wages paid

- Employment-related information

You must keep these records for a specific period specified by the FLSA.

FLSA Timekeeping Requirements

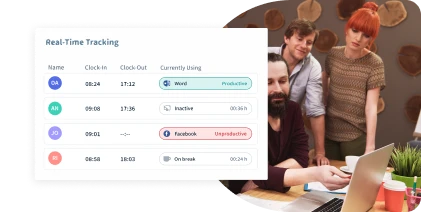

Employers must implement effective timekeeping systems to accurately track employees’ work hours, including regular and overtime hours

Timekeeping records should include the following:

- Start and end times

- Break periods

- Relevant time-related information

That’s it!

Now, we will understand the meaning of working time as per FLSA.

Understanding Working Time under the FLSA

The FLSA defines working time as the total hours an employee must be on duty, including:

- Productive work

- Waiting time

- On-call time

It also includes rest periods that are less than 20 minutes.

It encompasses both the hours spent performing job-related activities (on-off duty) and the time during which an employee is on duty.

Different Types of Working Time under the FLSA

There are various types of working time, such as:

Compensable Working Time

The FLSA mandates that compensable working hours must be paid at the minimum wage rate and may be subject to overtime pay.

It includes time spent on the following activities:

- Performing job duties

- Attending meetings or training

- Waiting time under certain circumstances

- The on-call time that restricts personal activities

Non-Compensable Time

Non-compensable time refers to hours during which employees are not on duty and are free to engage in personal activities.

Examples include bona fide meal breaks lasting more than 20 minutes and time when employees are completely relieved from duty and can pursue their own interests.

Regular Working Hours

The FLSA puts no limit on the working hours of an employee aged 16 or older who may work in a week.

However, it establishes that non-exempt workforce must be paid the minimum wage for hours worked up to 40 hours in a workweek.

Overtime Hours

The FLSA requires that non-exempt employees get overtime equivalent to 1.5 times their regular pay rate for every hour worked beyond 40 in a workweek.

Some exceptions and exemptions apply to particular types of:

- Job positions

- Industries

- Salary levels

Now, we will check some interesting facts related to FLSA.

Top 6 Facts about Fair Labor Standards Act (FLSA)

Here are the facts that you are looking for:

Meal Breaks and Rest Periods

The FLSA doesn’t ask employers to provide meal breaks or rest periods.

However, if any company provides short breaks (usually 5 to 20 minutes), they must be included in hours worked and compensated.

On-Call and Waiting Time

On-call time may be considered compensable if employees are restricted from engaging in personal activities during that time.

Child Labor Restrictions

The FLSA establishes specific regulations regarding working hours for employees under the age of 16.

Enforcement and Penalties

Employers found to violate FLSA regulations may face specific actions such as:

- Penalties

- Fines

- Any legal action

FLSA State Law Variations

Some states have labor laws that may provide additional protections or requirements beyond the federal FLSA regulations.

Exemptions for Certain Job Categories

The FLSA provides exemptions for specific job categories, such as:

- Executive

- Administrative

- Professional

- Computer-related positions

These exemptions are based on specific criteria regarding job duties, responsibilities, and salary levels.

Closing Thoughts

Understanding working time regulations under the Fair Labor Standards Act (FLSA) is vital for employers and employees.

Adhering to the FLSA guidelines ensures fair compensation, protects workers’ rights, and promotes a healthy work-life balance.

By upholding the principles of the FLSA, companies can foster a more equitable and productive work environment while prioritizing the well-being of their workforce.

About Workstatus

At Workstatus, we are dedicated to helping organizations and individuals work smarter, not harder, with the help of the following features:

- Online Timesheets

- Productivity Management

- Employee Monitoring

- GPS Tracking

- Geofencing

- Attendance Management

- Employee Scheduling

- Time Tracking

- Selfie Validation

- Automated Reporting System

Workstatus provides valuable insights into work hours, helping industries optimize their productivity and achieve a healthier work-life integration.

Workstatus caters to the following industries:

- Accounting

- Architects & Engineer

- Consultant

- Design

- Healthcare

- Landscaping

- Real Estate

- Agency

- Attorney

- Construction

- Ecommerce

- Janitorial services

- Manufacturing

- Software Development

FAQs

Q: How many hours can an employee work in a week under the FLSA?

A: The FLSA does not define any limit on the working hours that employees aged 16 and older can work in a week.

Q: Are employers required to provide meal breaks under the FLSA?

A: The FLSA does not mandate employers to provide meal breaks; however, if breaks are provided, they must be compensated if they last less than 20 minutes.

Q: Do employees have the right to overtime pay?

A: Non-exempt employees can get overtime pay equivalent to

1.5 times their regular pay rate.

This is to be paid for every hour they work beyond 40 in a workweek.

Q: Is on-call time considered working time under the FLSA?

A: On-call time may be considered compensable if employees are restricted from engaging in personal activities during that time.

Q: Are there exemptions to the FLSA regulations on working time?

A: Yes, certain job positions, industries, and salary levels may qualify for exemptions from specific FLSA regulations on working time.