Table of Contents

Have you ever wondered what lies beneath the numbers on a company’s balance sheet?

While revenue & expenses may paint a picture of financial health, one crucial factor often goes unnoticed: the true cost of employees.

This blog post will uncover the hidden costs associated with employees. We will be going to cover the following:

- Traditional Employee Costs

- How to determine employee cost?

- Calculating direct & indirect employee expenses

- Hidden Costs of Employees

- How do we optimize employee costs?

Join us on this journey as we explore the true cost of employees & how to leverage data & technology to reduce those costs.

Let’s get started.

Understanding Traditional Employee Costs

In business finance, understanding the true cost of employees goes beyond merely considering their salaries & wages.

Let’s take a closer look at the components that make up traditional employee costs, offering you a comprehensive understanding of how they impact your bottom line.

1) Salary & Wages:

When we think of employee costs, the first thing that comes to mind is the salaries & wages paid to the workforce.

It represents the direct compensation for their time & effort dedicated to the company.

For instance, let’s consider a small startup that employs five individuals with an average annual salary of $50,000 each.

The total salary expense for the company would be $250,000 per year.

2)Benefits & Insurance:

Besides their salaries, companies often provide various benefits & insurance coverage to attract & retain talent. These benefits may include:

- Health insurance

- Dental coverage

- Retirement plans

These perks enhance employee satisfaction & add to the overall cost of employment.

For example, if the company’s benefits package costs $10,000 per employee annually, the total benefits expense for our startup with five employees would be $50,000 annually.

3)Payroll Taxes & Contributions:

Employers are responsible for payroll taxes & contributions, separate from an employee’s salary. These include taxes for:

- Social Security

- Medicare

- Unemployment insurance

- Contributions to state & federal programs

The percentage varies based on location & applicable laws.

Let’s assume the total payroll taxes & contributions amount to 15% of the total employee wages. For our startup, this would be $37,500 per year.

4)Training & Development Expenses:

Investing in employee training & development is crucial for improving:

- Skills

- Knowledge

- Performance

These expenses encompass

- Workshops

- Seminars

- Online courses

Suppose our startup allocates $5,000 per employee annually for training & development. The total expense for all five employees would be $25,000 per year.

5)Workplace Amenities & Perks:

Companies often offer amenities & perks to create a conducive & enjoyable work environment. These could include:

- Office snacks

- Gym memberships

- Flexible working hours

Such perks contribute to the employee experience but also add to the overall cost.

For example, if our startup spends an average of $2,000 per employee on workplace amenities, the total expense would amount to $10,000 per year.

Understanding these traditional employee costs is essential for businesses to comprehensively view their financial commitments.

When we add up the figures for our small startup, the total cost of employees would be:

Total Employee Costs = ( Total Salaries + Total Benefits + Total Payroll Taxes + Total Training Expenses + Total Workplace Amenities Total)

Employee Costs = $250,000 + $50,000 + $37,500 + $25,000 + $10,000 = $372,500 per year

By breaking down these costs, companies can identify areas for optimization & cost-saving measures without compromising the well-being of their valuable workforce.

How to determine employee cost?

Determining employee cost is a critical aspect of managing your business finances effectively.

On average, employee cost ranges from 1.25 to 1.4 times the team member’s salary, but this figure can vary based on several factors.

For instance, the benefits the business owner offers, overhead costs, & the total number of employees play a significant role in the final cost calculation.

According to data from the Bureau of Labor in 2021, the average salary cost for private industry team members was approximately $26.86 per hour worked, with benefit costs averaging around $11.22.

This means the total cost of employing a single individual can range from $38.08 to over $45 per hour.

With this in mind, business owners must consider all employee costs when calculating their costs & budget accordingly.

How to Calculate Employee Cost?

To accurately determine the true cost of an employee, consider the following formula:

Employee Cost = (Salary or Wages) + (Benefits & Insurance) + (Payroll Taxes & Contributions) + (Training & Development Expenses) + (Workplace Amenities & Perks)

Let’s use a numerical example to illustrate this formula:

- Employee Salary: $50,000 per year

- Benefits & Insurance: $10,000 per year

- Payroll Taxes & Contributions: 15% of Salary

- Training & Development Expenses: $2,000 per year

- Workplace Amenities & Perks: $1,000 per year

- Employee Cost = ($50,000) + ($10,000) + (15% of $50,000) + ($2,000) + ($1,000)

- Employee Cost = $50,000 + $10,000 + $7,500 + $2,000 + $1,000

Employee Cost = $70,500

Accounting For Intangible Factors Affecting Employee Costs:

In addition to tangible expenses, it’s crucial to consider intangible factors that impact employee costs. These may include:

- Employee Morale: Low morale can lead to decreased productivity & increased turnover, affecting overall costs.

- Work-Life Balance: Employees with a healthy work-life balance tend to be more engaged & loyal.

- Company Culture: A positive & supportive culture can attract & retain top talent.

Incorporating Employee Performance & Productivity Metrics:

Employee performance & productivity significantly influence costs. Consider metrics such as:

- Revenue Per Employee: Calculate how much revenue each employee generates on average.

- Absenteeism Rate: Track the frequency of employee absences to identify potential productivity issues.

- Employee Retention Rate: Measure the percentage of employees who stay with the company over time.

By incorporating these metrics, you can assess the impact of employee performance on your organization’s financial health & make data-driven decisions to improve productivity & reduce costs.

Hidden Costs of Employees

1)Employee Turnover & Recruitment Expenses:

Employee turnover can be a significant hidden cost for businesses.

When an employee leaves, there are expenses related to recruiting & hiring a replacement. These costs include:

- Job advertisements

- Recruitment agency fees

- Interview expenses

- Onboarding costs for the new employee

Let’s consider a numerical example:

- Annual Turnover Rate: 15%

- Average Recruitment Expense per Employee: $2,000

Calculation:

- Total Recruitment Expenses = Annual Turnover Rate * Average Recruitment

Expense per Employee

- Total Recruitment Expenses = 0.15 * $2,000

- Total Recruitment Expenses = $300 per employee

2)Administrative Overhead for HR & Payroll Processing:

HR & payroll processing require time & resources, leading to administrative overhead costs. These expenses encompass:

- HR staff salaries

- Payroll software

- Office supplies

- Other administrative expenses

For instance:

- HR Staff Salaries (Annual): $100,000

- Payroll Software & Office Supplies (Annual): $5,000

Calculation:

- Total Administrative Overhead = HR Staff Salaries + Payroll Software & Office Supplies

- Total Administrative Overhead = $100,000 + $5,000

- Total Administrative Overhead = $105,000

3)Absenteeism & Its Impact on Productivity:

Absenteeism, whether due to illness, personal reasons, or disengagement, can lead to reduced productivity & increased workload for other employees.

Calculate the cost of absenteeism using the following example:

Average Employee Salary per Day: $200

Average Annual Absenteeism Days per Employee: 10 days

Calculation:

- Total Absenteeism Costs = Average Employee Salary per Day * Average Annual

Absenteeism Days per Employee

- Total Absenteeism Costs = $200 * 10

- Total Absenteeism Costs = $2,000 per employee

4)Employee Disengagement & Reduced Efficiency:

Disengaged employees are less productive, leading to inefficiencies & missed opportunities.

Calculating the exact cost of disengagement can be challenging, but you can estimate it based on decreased productivity & potential revenue loss:

Estimated Productivity Loss per Disengaged Employee (Annual): $5,000

Number of Disengaged Employees: 5

Calculation:

- Total Cost of Employee Disengagement = Estimated Productivity Loss per

Disengaged Employee * Number of Disengaged Employees

- Total Cost of Employee Disengagement = $5,000 * 5

- Total Cost of Employee Disengagement = $25,000

Potential Legal Liabilities & HR-related Lawsuits:

HR-related lawsuits & legal liabilities can arise from various issues, including:

- Discrimination claims

- Workplace accidents

- Labor law violations

Significant hidden costs include legal expenses, settlements, & potential damage to the company’s reputation. Let’s assume:

Legal Expenses & Settlements (Annual): $50,000

Calculation:

Total Legal Liabilities = Legal Expenses & Settlements

Total Legal Liabilities = $50,000

Mitigating these hidden expenses through effective HR strategies & employee engagement initiatives can lead to long-term cost savings & improved organizational performance.

Introducing Workstatus: Your Financial Efficiency Solution

In pursuing financial efficiency, businesses understand the importance of accurately calculating the true cost of employees.

Workstatus emerges as a powerful solution, offering a comprehensive platform for time tracking & employee monitoring.

By utilizing Workstatus, companies can gain valuable insights into:

- Employee productivity

- Streamline financial processes

- Make data-driven decisions to optimize workforce costs

Features Of Workstatus That Help In Calculating Employee Costs:

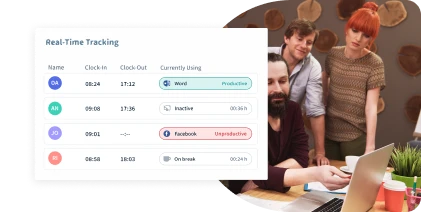

1) Time Tracking & Activity Monitoring: Optimizing Employee Hours

Workstatus allows precise tracking of employee working hours & activities.

By monitoring time spent on tasks & projects, businesses can accurately determine the labor cost of each undertaking.

This invaluable feature enables managers to optimize employee hours, ensuring enhanced productivity while staying within budgetary constraints.

2)Payroll Management & Invoicing: Streamlining Financial Processes

Workstatus simplifies payroll management by automating time data & generating accurate timesheets.

With seamless integration into payroll systems, businesses can effortlessly:

- Calculate employee earnings

- Reduce the risk of errors

- Saving time

Additionally, the software streamlines client invoicing, ensuring that billable hours are accurately recorded & accounted for.

3)Performance & Productivity Analytics: Data-Driven Insights

Workstatus provides detailed performance analytics, offering objective individual & team productivity insights.

By analyzing productivity trends & identifying areas for improvement, companies can:

- Optimize resource allocation

- Maximize output

- Ultimately leading to improved cost efficiency

4)Integrations With Other Business Tools: Seamless Workflow

Workstatus integrates with other essential business tools, such as project management platforms & collaboration software.

This integration allows for a smooth data flow, ensuring that all aspects of employee costs are consolidated in one central location.

The result is enhanced efficiency in decision-making & resource allocation.

With its features & user-friendly interface, Workstatus emerges as a valuable asset for businesses seeking to delve into the true cost of employees.

By leveraging Workstatus, companies can take proactive steps towards:

- Optimizing their workforce

- Achieving financial transparency

- Unlocking greater cost savings for sustained growth & success

Next World

In conclusion, “Behind the Balance Sheet: the True Cost of Employees” has shed light on the often overlooked aspect of business accounting – the true cost of employees.

Throughout this exploration, we realized that employee-related expenses extend beyond mere salaries & benefits. Factors like:

- Training

- Turnover

- Productivity

- Contribute significantly to the cost of maintaining a workforce.

Acknowledging the true cost of employees is crucial for making informed business decisions & achieving sustainable growth.

By understanding the comprehensive expenses associated with human capital, companies can:

- Optimize their resources

- Increase efficiency

- Foster a more supportive work environment

As the next step, we encourage business leaders & decision-makers to consider implementing Workstatus. This advanced employee management tool offers valuable insights into:

- Workforce productivity

- Time tracking

- Project management

- Employee engagement

With Workstatus, companies can gain real-time visibility into:

- Employee activities

- Identify potential cost-saving opportunities

- Create a more productive & engaged workforce, leading to greater cost efficiency & sustained business success.

FAQs

How does Workstatus contribute to overall business performance?

Workstatus improves overall business performance by providing data-driven insights & optimization opportunities. With:

- Better resource allocation

- Streamlined processes

- Enhanced employee productivity

- Businesses can achieve higher efficiency & profitability.

Can Workstatus integrate with other business tools?

Yes, Workstatus offers seamless integrations with various business tools, including project management platforms & collaboration software. This:

- Integration streamlines data flow

- Centralizes information

- Enhances workflow efficiency

How can I get started with Workstatus for my business?

Getting started with Workstatus is simple!

- Visit our website

- Sign up for a free trial

- Schedule a demo with our team

We’ll guide you through the implementation process & help you unlock the full potential of Workstatus for improving cost efficiency & achieving business success.