Table of Contents

Are you a California resident working long hours without receiving the overtime pay you deserve?

It’s time to shed light on California’s overtime laws!

Whether you’re an employer struggling to comply or an employee seeking fair compensation, this blog post is your ultimate guide.

From understanding key definitions to learning how it affects different industries, we’ve got your back! So, let’s dive in

A. Definition of overtime

Overtime is the extra compensation eligible employees receive for working more than the standard hours designated for their job.

It is typically calculated based on the additional hours worked beyond the regular work hours within a specific workday or workweek.

B. Applicability of the law

The California Overtime Law applies to most employees who are not exempt &work in California.

Non-exempt employees are those who are not exempt from the overtime provisions of the law. They are entitled to receive overtime pay for any hours worked beyond the established limits.

On the other hand, exempt employees are not covered by the overtime provisions &therefore do not receive overtime pay.

To understand the difference between exempt &non-exempt employees more clearly, please refer to the table below:

It’s important for employers to accurately determine whether an employee is exempt or non-exempt, as this classification affects their entitlement to overtime pay.

Why Was California Overtime Law Needed?

The California Overtime Law was needed to ensure fair compensation for employees who work beyond standard hours.

Its implementation was necessary to address issues such as:

- Employee exploitation

- Excessive work hours without proper compensation

- To promote a healthy work-life balance

Before the establishment of this law, some employers took advantage of their employees by requiring them to work long hours without additional pay.

This practice often resulted in overworked &underpaid employees, leading to:

- Increased stress

- Fatigue

- Reduced productivity

By enacting the California Overtime Law, the state aimed to protect the rights of employees &promote a fair &equitable work environment.

The law establishes guidelines &requirements for employers to calculate &compensate employees for their overtime hours at a higher rate than their regular pay.

It serves as a mechanism to discourage employers from overburdening employees with excessive work hours without appropriate compensation.

Key Requirements & Implications For Employers

Classifying Employees Correctly

Employers must accurately classify their employees as exempt or non-exempt based on the specific exemption criteria outlined in the California Overtime Law.

Misclassifying employees can lead to legal consequences, including:

- Back payment of unpaid wages

- Penalties

- Potential lawsuits

Employers should regularly review &update employee classifications to ensure compliance with the law &avoid potential liabilities.

Tracking & Documenting Hours Worked

Employers are required to accurately track &document the hours worked by their non-exempt employees, including both regular &overtime hours.

This documentation is essential to calculate &pay overtime wages accurately, as well as to demonstrate compliance in the event of an audit or legal dispute.

Effective time tracking systems or software can help employers streamline this process &maintain accurate records of employee work hours.

Simplify your time tracking process with Workstatus.

Start Free Trial Today

Calculating &Paying Overtime Wages

Employers must calculate overtime wages based on the employee’s regular hourly rate &pay a premium rate for each hour worked beyond the standard workday (more than 8 hours) or workweek (more than 40 hours).

Overtime wages should be paid in addition to the employee’s regular wages &must be clearly documented on the employee’s pay stub.

Failure to pay overtime wages correctly can result in legal liabilities, including back pay, penalties, &potential legal action by employees.

Providing Meal &Rest Breaks

Employers must provide non-exempt employees with mandatory meal &rest breaks as prescribed by California labor laws.

Meal breaks of at least 30 minutes should be provided to employees who work more than 5 hours in a workday, with additional breaks for longer shifts.

Rest breaks of at least 10 minutes per every 4 hours worked must be given to employees.

Employers should establish policies &procedures to ensure employees are aware of their break entitlements & can take their required breaks.

Ensuring Compliance With Record-Keeping Requirements

Employers must maintain accurate records of employee work hours, wages, &other relevant employment information for a specific period.

Records should include employee names, dates worked, hours worked per day, breaks taken, &overtime hours.

Compliance with record-keeping requirements is essential to demonstrate adherence to labor laws &can assist in resolving any disputes or audits related to overtime or wage violations.

Potential Challenges & Concerns For Employers

Misclassification Risks & Consequences

Misclassifying employees as exempt when they should be non-exempt can lead to significant legal &financial consequences for employers.

It’s essential to accurately classify employees based on their job duties &meet the criteria outlined in the California Overtime Law.

Some risks &consequences include:

- Fines &penalties for non-compliance

- Back pay for unpaid overtime

- Legal claims &lawsuits from employees

- Damage to the company’s reputation

Complex Calculations For Overtime Pay

Calculating overtime pay can be a complex &time-consuming task for employers.

The California Overtime Law has specific rules regarding how overtime should be calculated, including different rates for daily &weekly overtime.

Some challenges employers may face include:

- Determining the correct overtime rate based on the employee’s regular rate of pay

- Accounting for different pay structures, such as bonuses &commissions

- Tracking &calculating overtime for employees with fluctuating work schedules

Ensuring Compliance With Meal &Rest Break Laws

California Overtime Law also includes requirements for providing meal &rest breaks to employees.

Employers must ensure employees receive their entitled breaks within specific timeframes. Compliance challenges may include:

- Managing employee schedules to allow for uninterrupted meal &rest breaks

- Keeping accurate records of breaks taken by employees

- Addressing situations where employees voluntarily choose to skip or shorten breaks

Managing Employee Schedules &Workloads

Balancing employee schedules &workloads while adhering to California Overtime Law can be challenging.

Employers need to ensure that employees are not overworked, which can lead to exhaustion &decreased productivity. Key concerns include:

- Creating schedules that align with the law’s requirements for maximum hours worked

- Monitoring &adjusting workloads to avoid excessive overtime

- Effectively communicating &managing employee availability &preferences

These were some challenges &concerns regarding California Overtime Law. With such a complex law, employers must be vigilant in understanding &complying with its provisions.

With the right tool in place, employers can ensure they are fully compliant with the law.

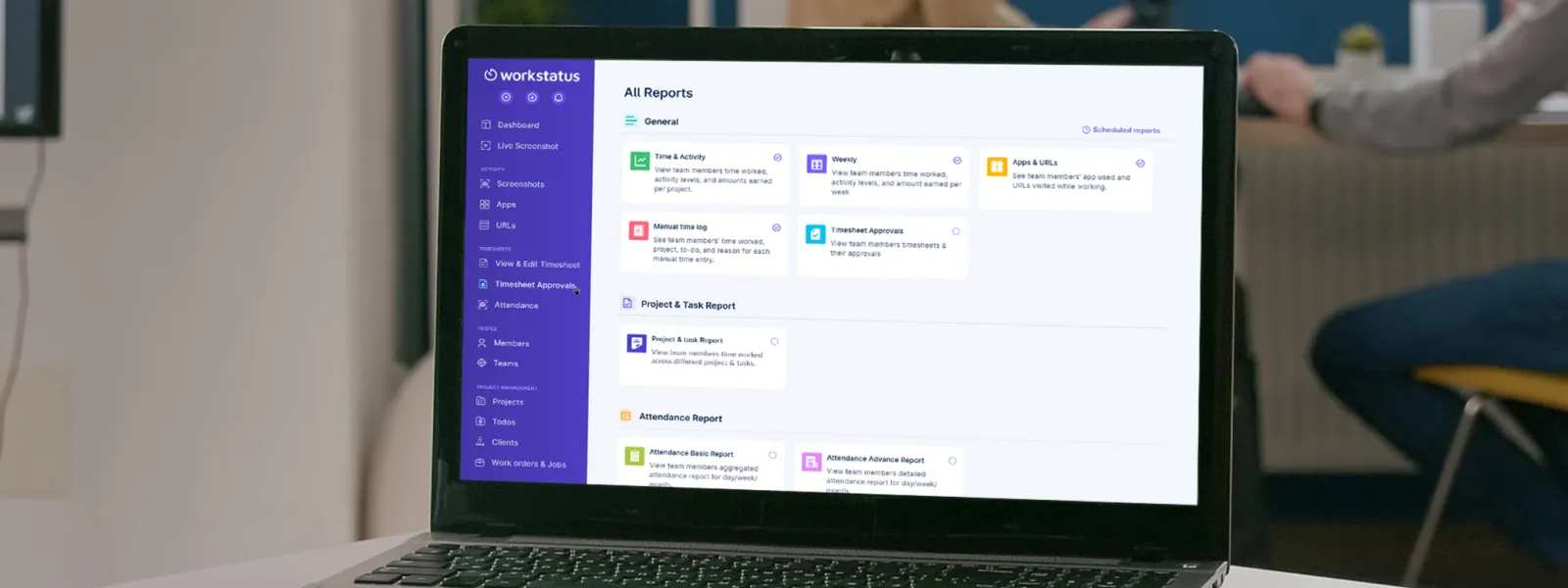

Introducing Workstatus

Workstatus is a powerful time tracking software that enables employers to manage &track employee work hours easily, ensuring compliance with California Overtime Law.

With its intuitive features &robust capabilities, Workstatus helps employers in the following ways

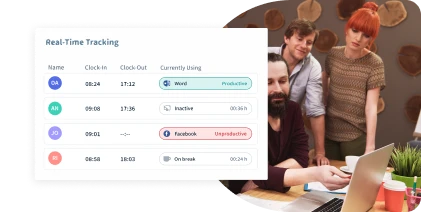

Accurate Time Tracking

Workstatus provides robust time tracking features that enable employers to track employee work hours accurately.

With precise time tracking, employers can ensure compliance with California Overtime Law’s requirements &have a clear record of hours worked by each employee.

Key features include:

- Manual time entry or automatic time tracking with the Workstatus timer

- Real-time monitoring of employee activity &hours worked

- Break &idle time tracking to differentiate between working &non-working hours

Automated Overtime Calculations With Automatic Timer

![tasks-01[1]](https://www.workstatus.io/wp-content/uploads/2023/02/tasks-011.png.webp.webp)

Calculating overtime can be complex, especially with varying rates & thresholds.

Workstatus simplifies this process by automatically calculating overtime based on California Overtime Law rules.

Key features include:

- Automatic calculation of daily &weekly overtime rates

- Adjustment of overtime calculations based on different pay structures (e.g., bonuses, commissions)

- Real-time visibility of overtime hours accumulated by each employee

Customizable Meal & Rest Break Reminders

Workstatus helps employers ensure compliance with meal &rest break laws by providing customizable reminders & idle time notifications.

These features help maintain employee adherence to break requirements.

Key features include:

- Configurable break reminders based on specific intervals or fixed times

- Idle time notifications to alert employees &managers when breaks are not taken as required

- Automatic recording of break durations for accurate record-keeping

Employee Scheduling &Workload Management Tools

Workstatus offers robust scheduling &workload management features to help employers effectively manage employee schedules while adhering to California Overtime Law.

Key features include:

- Shift planning &assignment of work hours to employees

- Real-time visibility of employee availability &scheduled hours

- Load balancing to distribute workload &avoid excessive overtime

Detailed Reports & Audit Trails

Workstatus generates comprehensive reports &audit trails that provide a clear overview of employee work hours &compliance with California Overtime Law.

Key features include:

- Detailed time logs ×heets for each employee

- Overtime reports with breakdowns of regular &overtime hours

- Audit trails for tracking any changes or modifications to time entries

Integration With Payroll Systems

Workstatus seamlessly integrates with various payroll systems, simplifying the process of calculating &processing payroll while ensuring accurate overtime calculations. Key features include:

- Integration with popular payroll software for streamlined payroll management

- Automatic transfer of time &attendance data for accurate payroll processing

- Reduction of manual errors &time spent on payroll administration

By leveraging the powerful features offered by Workstatus, employers can effectively manage employee time, comply with California Overtime Law, mitigate risks.

Next Step

In conclusion, understanding the California overtime law is crucial for both employers &employees in the state.

This comprehensive legislation ensures that workers are fairly compensated for their extra hours of work & provides important protection against exploitation.

By familiarizing themselves with the key provisions of the law, employers can avoid legal issues & maintain a harmonious work environment.

Employees, on the other hand, can confidently assert their rights & seek appropriate compensation for their overtime hours.

To further simplify the process of managing overtime &ensuring compliance with the law, employers & employees can consider utilizing Workstatus.

Workstatus is an innovative workforce management software that helps:

- Streamline time tracking

- Automate overtime calculations

- Generate accurate reports

By implementing Workstatus, both employers &employees can save time, improve efficiency, &maintain accurate records of hours worked.

FAQs

Q. What are the penalties for violating California’s overtime laws?

Ans. Employers who violate California’s overtime laws may be subject to penalties, including:

- Paying the owed overtime wages

- Interest on the owed wages

- Potential civil penalties

Employees who have been denied overtime pay can file a claim with the California Labor Commissioner or pursue a lawsuit against their employer.

Q. How can employees ensure they are being paid correctly for overtime work?

Ans. To ensure you are being paid correctly for overtime work:

- Keep detailed records of your work hours

- Track start &end times for each shift

- Familiarize yourself with California’s overtime laws

- Consult your employer’s policies or employee handbook