Table of Contents

Introduction

Timesheets are the foundation for countless organizational financial, operational, and legal decisions. In the dynamic business world, the accuracy and compliance of timesheets are more critical than ever.

However, navigating timesheet management’s intricate legal requirements can often seem daunting.

In this blog post, we will discuss timesheet compliance in detail. You will also learn more about the legal considerations related to workforce management and how organizations can remain compliant.

Whether you’re running a multinational firm or a small start-up, this blog post will help ensure your business adheres to all applicable laws & regulations.

Timesheet Compliance and Its Significance

Timesheet compliance refers to accurately recording and submitting timesheets under the company’s policies and procedures and any applicable labor laws and regulations.

Consequences of Non-Compliance:

Legal Penalties: Failure to comply with labor laws & regulations can result in fines, legal disputes, and damage to an organization’s reputation.

Financial Impact: Non-compliance can lead to overpayment or underpayment of employees, affecting the bottom line. Incorrect billing in client-based industries can result in financial losses.

Operational Disruption: Inaccurate or incomplete timesheets can disrupt project schedules, leading to missed deadlines and dissatisfied clients.

Employee Discontent: Employees may become dissatisfied if they perceive inconsistencies or inaccuracies in their paychecks, which can negatively impact morale & retention.

These are just a few reasons why timesheet compliance is so important.

Now, look at the core timesheet compliance requirements businesses must consider when navigating complex legal considerations.

Federal Timesheet Compliance Requirements

Fair Labor Standards Act (FLSA)

The Fair Labor Standards Act (FLSA) mandates that every U.S. company must monitor employee work hours.

This 1938 law had a profound impact on American work culture, introducing significant changes such as:

- Establishing a minimum wage for all types of work.

- Imposing a 40-hour weekly work limit with a requirement to pay 150% for overtime.

- Prohibiting manufacturing and metallurgical labor for those under 18 and banning the employment of children under 16 during school hours.

Timesheet Legal Requirements

To comply with the FLSA, your timesheet document must include:

- Employee’s details: Full name, home address, occupation, gender, and birth date (for employees under 19).

- Start day and time of the workweek.

- Daily and weekly total hours worked.

- Earnings breakdown for each day and week.

- Overtime hourly rate.

- Total weekly overtime hours.

- Wage deductions or additions.

- Total wages for each pay period.

- Payment date and pay period reference.

Timesheet Federal Law Requirements

Federal law mandates that all companies maintain accurate records of employee work hours, whether hourly and non-exempt or exempt and salaried. These records should encompass:

- Daily total work hours

- Clock-in and clock-out times

- Breaks and meal times

- Overtime hours

- Total paid wages

- Other company timesheet policy details.

Hourly employees must be compensated at a rate of 1.5 times their hourly wage for workweeks exceeding 40 hours.

While tracking meal periods isn’t mandatory, breaks shorter than 20 minutes and meals under 30 minutes must be paid.

Non-compliance with these FLSA timekeeping requirements can result in penalties and fines. Therefore, establishing an effective timesheet data collection system is crucial.

Timesheet General Law Requirements

FLSA mandates that employers, including local, state, federal, union halls, healthcare, public agencies, schools, and certain private companies with interstate operations or annual gross revenues exceeding USD 500,000, must adhere to its recordkeeping rules.

These regulations encompass minimum and overtime wages, youth employment standards, and timesheet policies, applying universally across these entities.

State Timesheet Compliance Requirements:

In addition to federal labor laws that apply universally across the United States, there are state-specific regulations & local ordinances that employers must consider.

Here are a few examples of state-level timekeeping laws:

California

California has specific requirements for timekeeping.

While paper timesheets are acceptable, employers in California must maintain accurate employee time records in English, using ink on paper timesheet forms.

Paper timesheets can suffice for small businesses; larger companies may find it more efficient to transition to digital timekeeping systems.

Washington

Washington state mandates that non-exempt employees receive 1.5 times their regular wages for hours worked beyond 40 per week. This overtime rule is crucial for employers to follow when calculating compensation.

Texas

Under the Texas Payday law, employers must maintain precise payroll records for each pay period. Furthermore, Texas law permits using timesheets and time clocks to track employee working hours, ensuring compliance with wage and hour regulations.

These are some of the most important legal requirements to remember when managing timesheet compliance.

However, meeting these requirements can be complex and error-prone without a robust solution.

Workstatus: Your All-In-One Solution For Timesheet Compliance

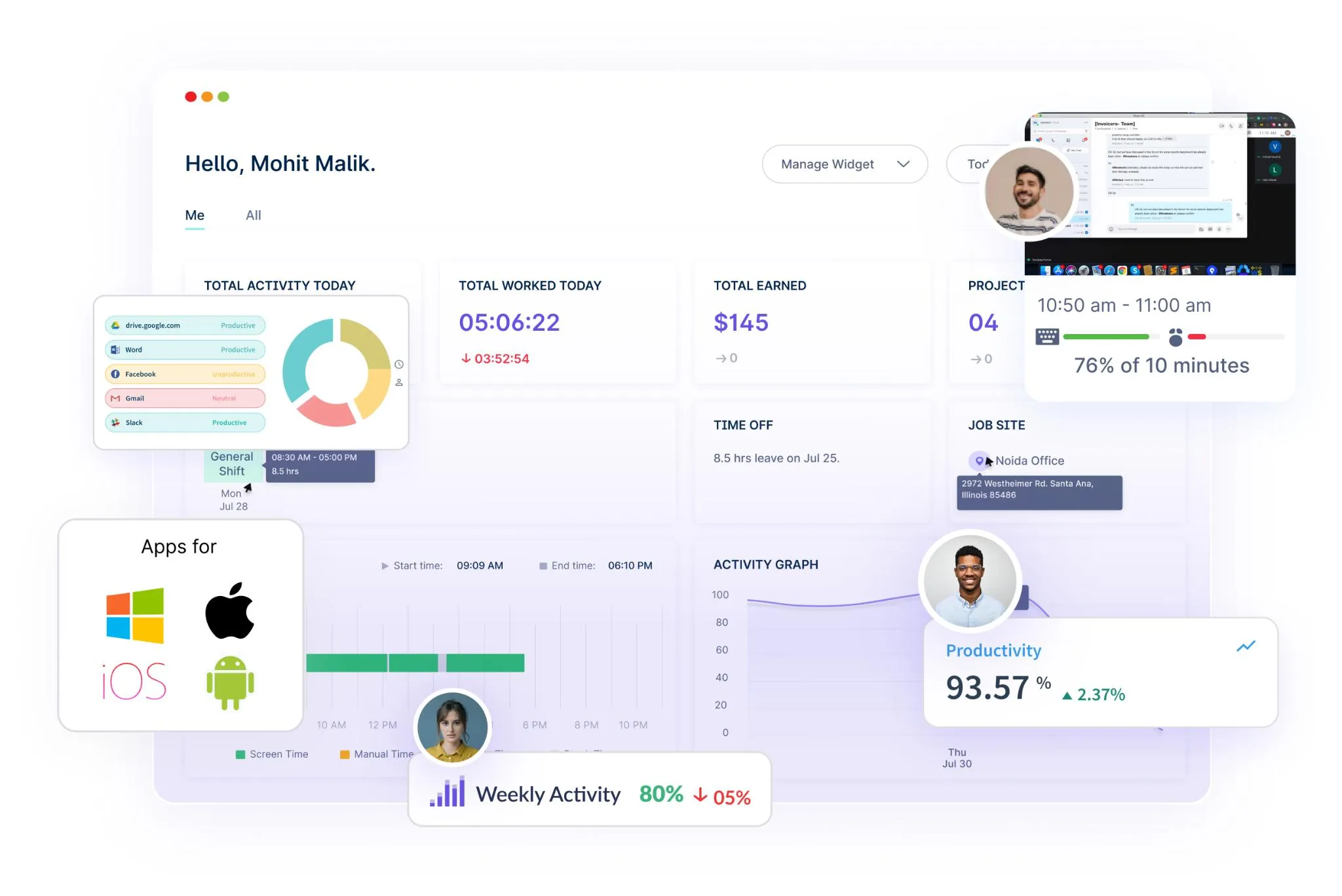

Workstatus simplifies adhering to timesheet legal requirements, providing businesses with a comprehensive solution to meet federal and state regulations. Here’s how Workstatus can address your timesheet compliance needs:

Workstatus simplifies adhering to timesheet legal requirements, providing businesses with a comprehensive solution to meet federal and state regulations. Here’s how Workstatus can address your timesheet compliance needs:

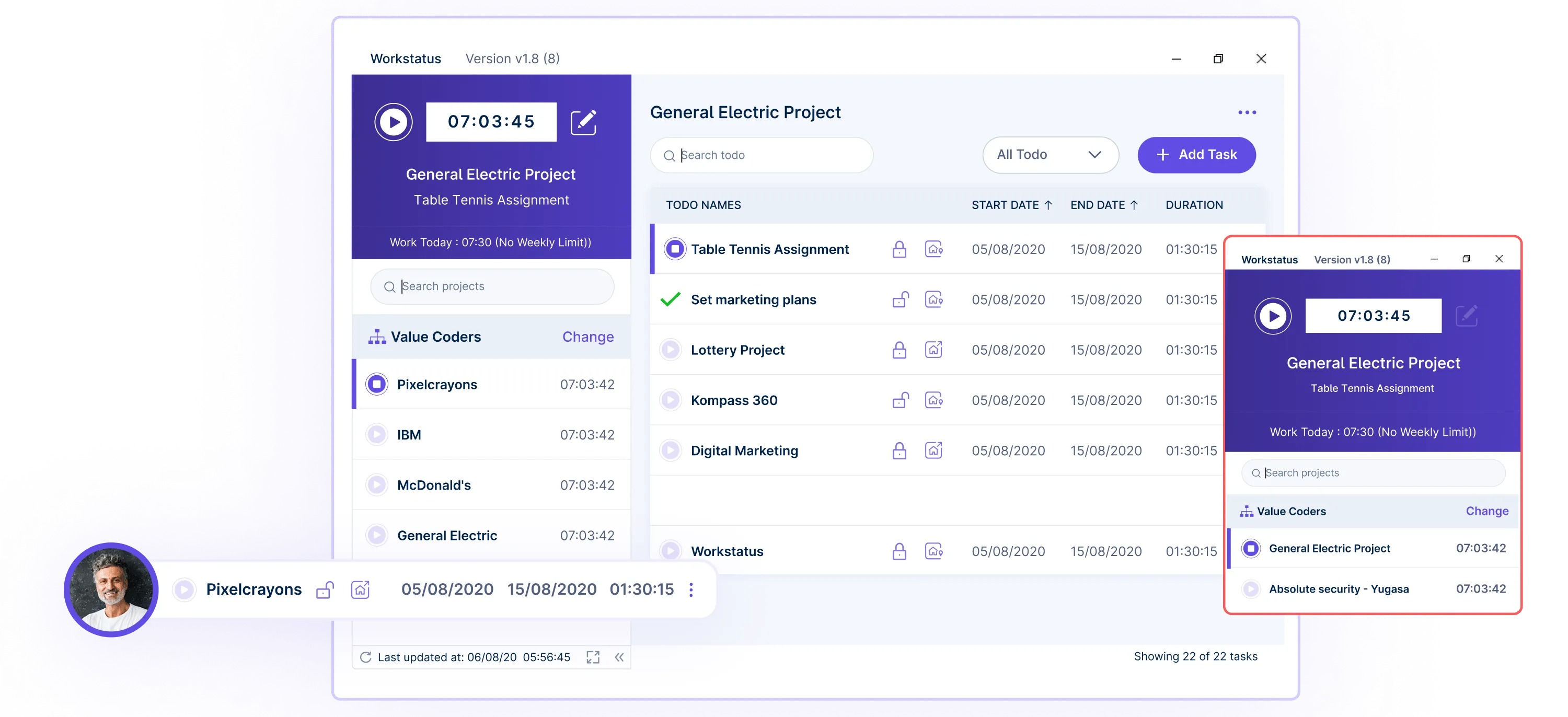

Accurate Time Tracking:

Accurate time tracking is the cornerstone of effective timesheet compliance, and Workstatus excels in this crucial area. With Workstatus, you can ensure precision in time recording through:

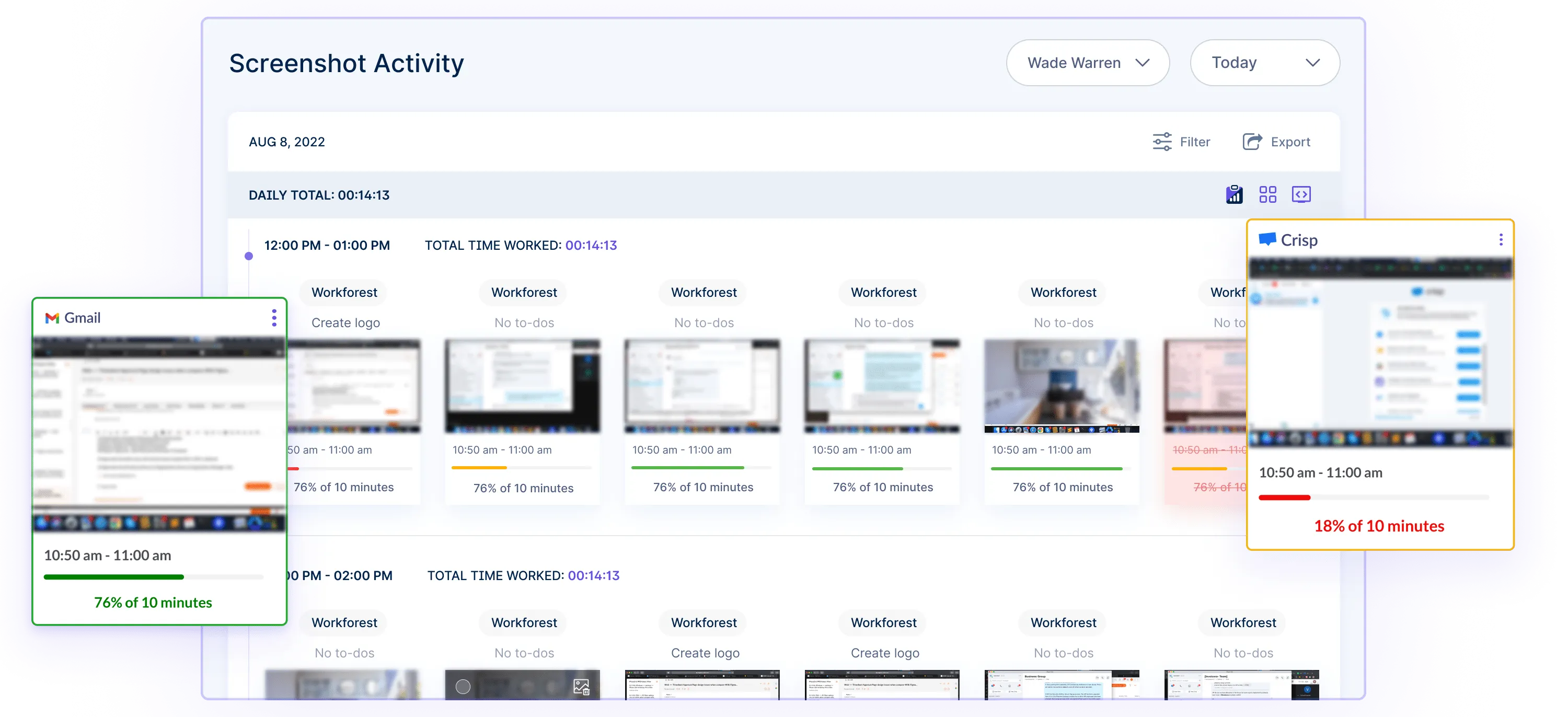

Automatic Tracking: Workstatus automatically captures when employees start and stop work, minimizing manual entries and errors.

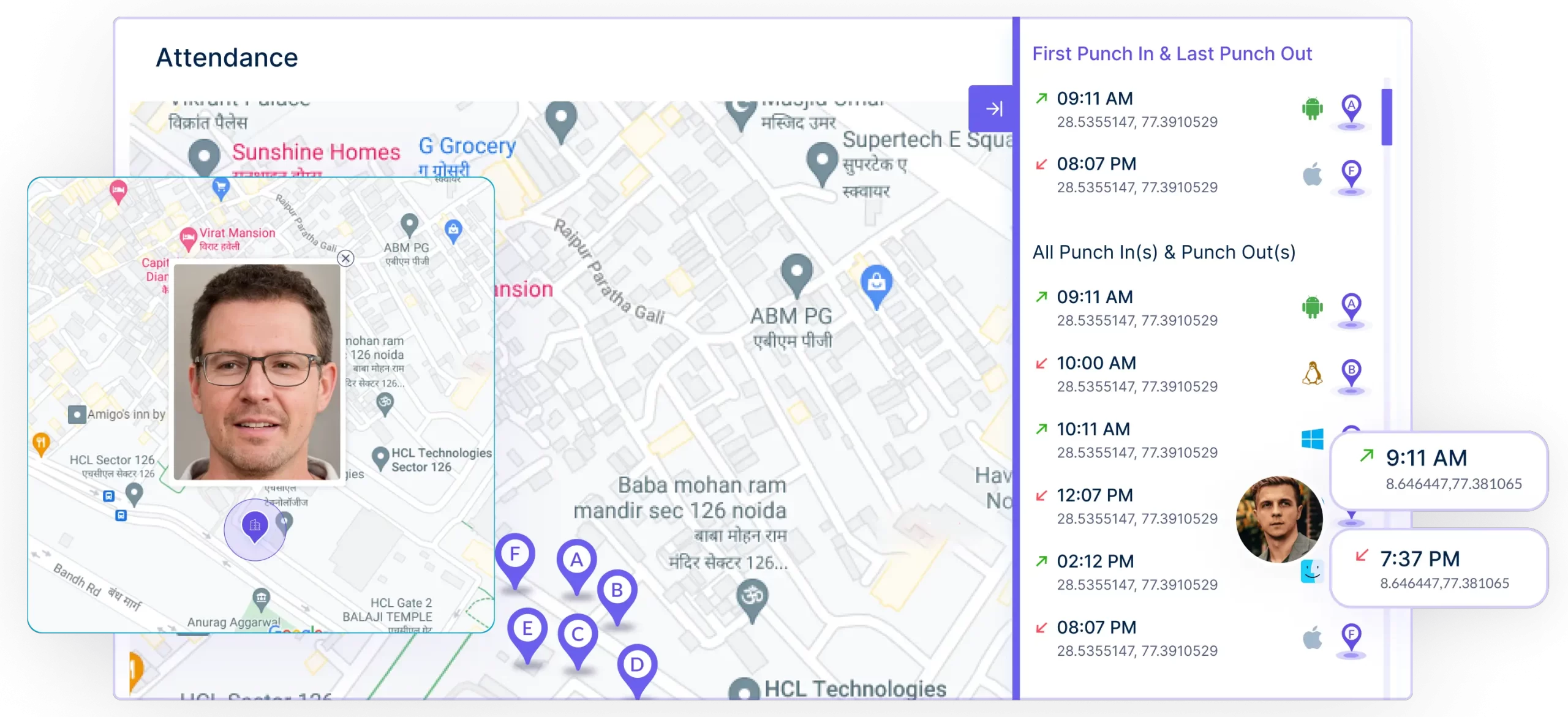

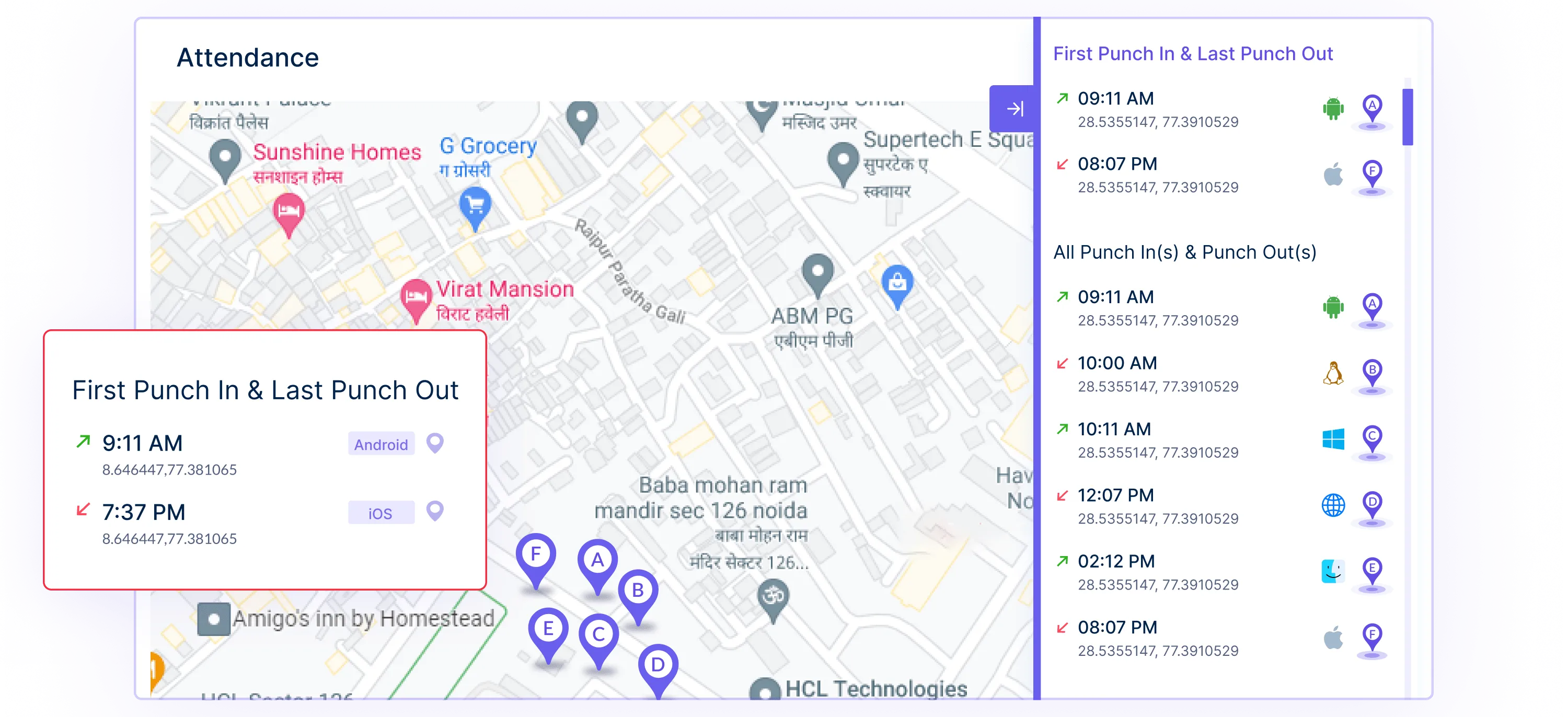

GPS Location Tracking: Verify the accuracy of remote employees’ work locations with GPS-based tracking.

GPS Location Tracking: Verify the accuracy of remote employees’ work locations with GPS-based tracking.

Activity Monitoring: Track productive and idle time to gauge actual work hours more accurately.

Activity Monitoring: Track productive and idle time to gauge actual work hours more accurately.

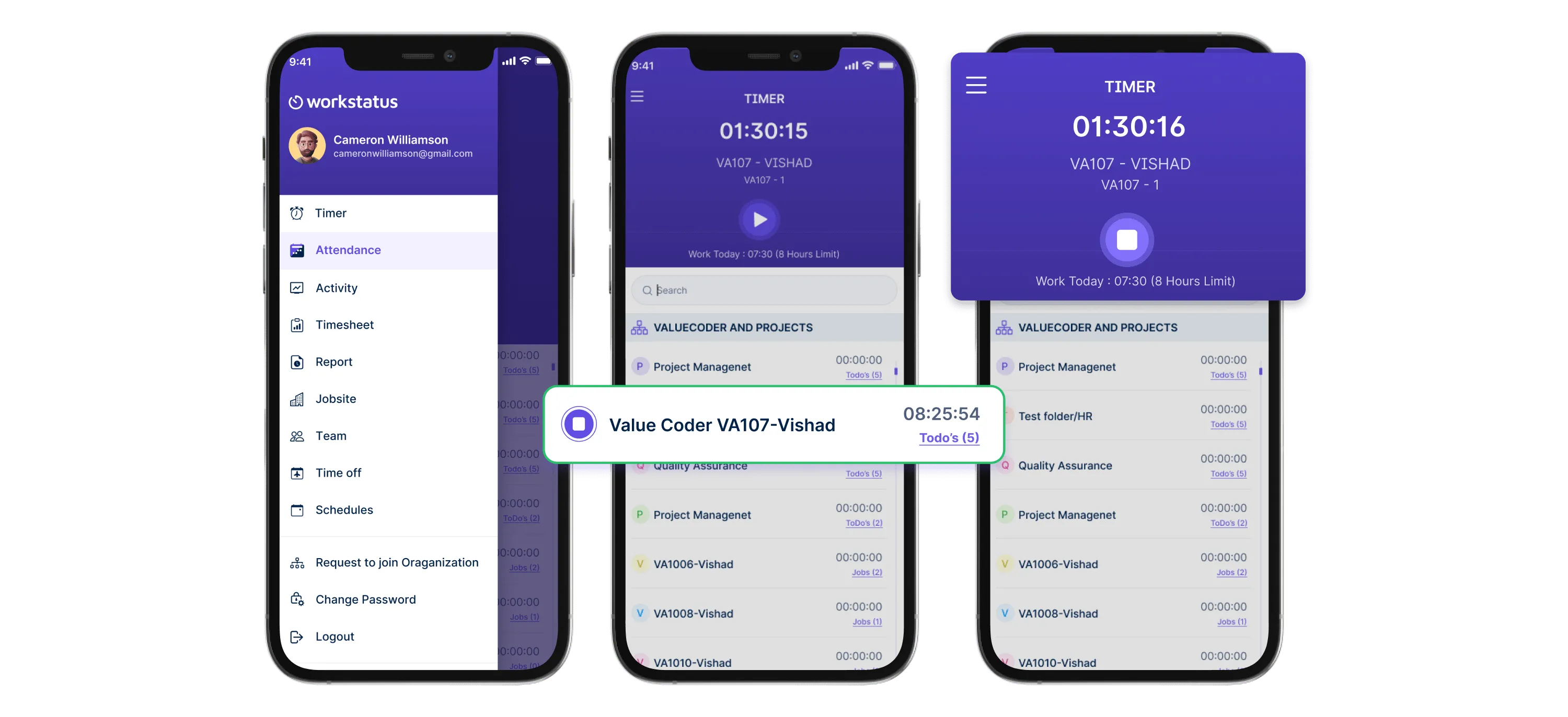

Desktop and Mobile Apps: Convenient apps make it easy for employees to track time on their preferred devices.

Desktop and Mobile Apps: Convenient apps make it easy for employees to track time on their preferred devices.

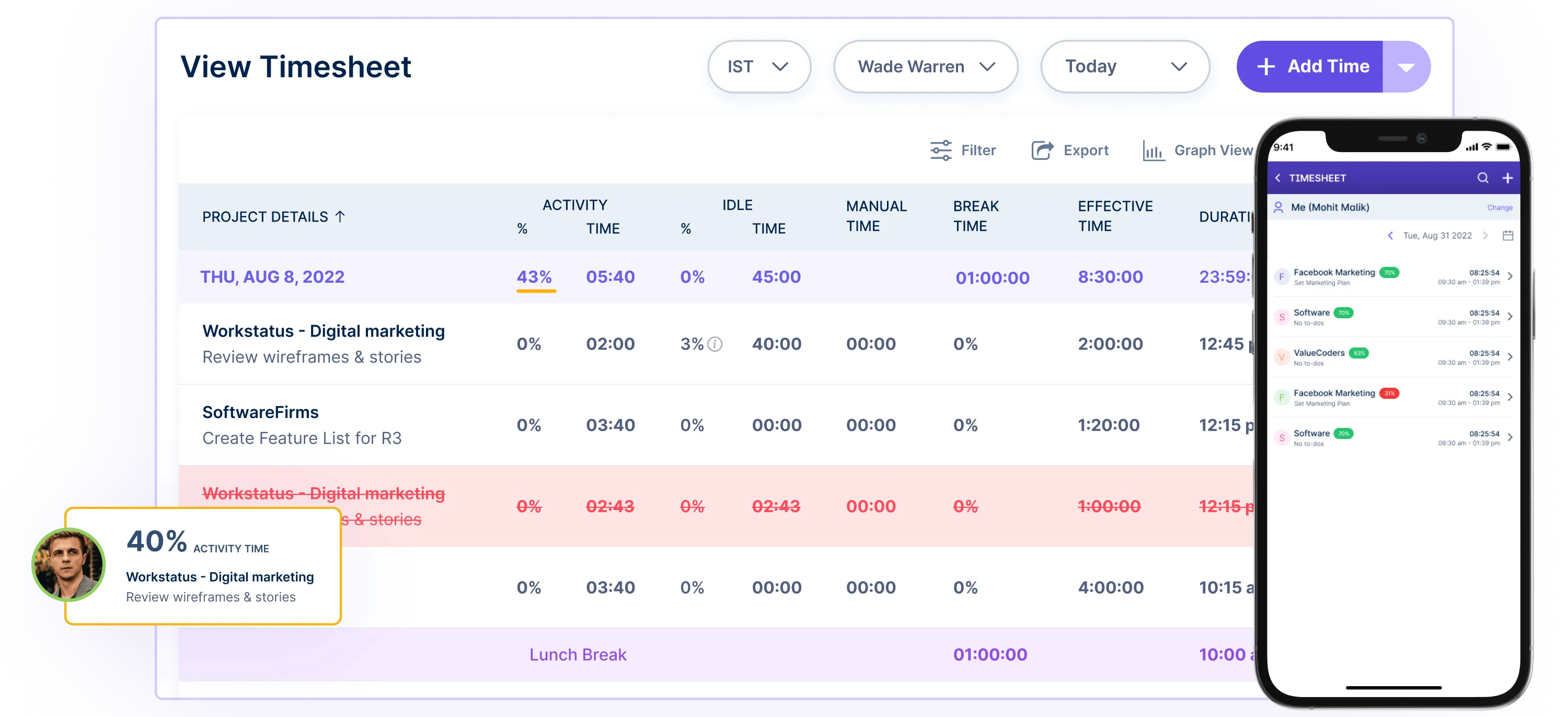

Overtime & Wage Laws Compliance:

Compliance with overtime and wage laws is a non-negotiable aspect of workforce management, and Workstatus simplifies this complex task by:

- Custom Overtime Rules: Set up rules to automatically calculate overtime pay based on your company’s policies and local regulations.

- Real-time Alerts: Receive notifications when employees approach or exceed overtime thresholds.

- Pay Rate Customization: Easily configure different pay rates for regular and overtime hours.

- Detailed Overtime Reports: To ensure compliance and identify potential issues, access comprehensive reports.

Remote Work and Flexibility:

The modern workforce often includes remote and flexible arrangements. Workstatus accommodates these dynamics by:

Remote Time Tracking: Allow remote employees to track time, even without a physical office presence accurately.

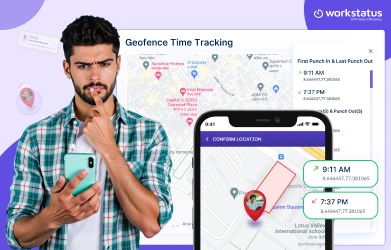

Geofencing: To ensure remote employees work from approved sites, define specific work locations.

Mobile Accessibility: Employees can track time using mobile devices, catering to their flexible work arrangements.

Screenshot and Activity Monitoring: Gain insights into remote workers’ productivity without invading their privacy.

Customization and Compliance Settings:

Workstatus recognizes that each business has unique compliance needs, offering a high degree of customization through:

- Flexible Policies: Tailor timesheet and compliance settings to align with your company’s requirements.

- Timesheet Approval Workflows: Establish multi-level approvals for timesheets, ensuring compliance with internal protocols.

- Role-Based Permissions: Assign different access levels to team members based on their responsibilities.

- Integration Capabilities: Seamlessly integrate Workstatus with other tools and systems you use for enhanced compliance.

Reporting and Analytics:

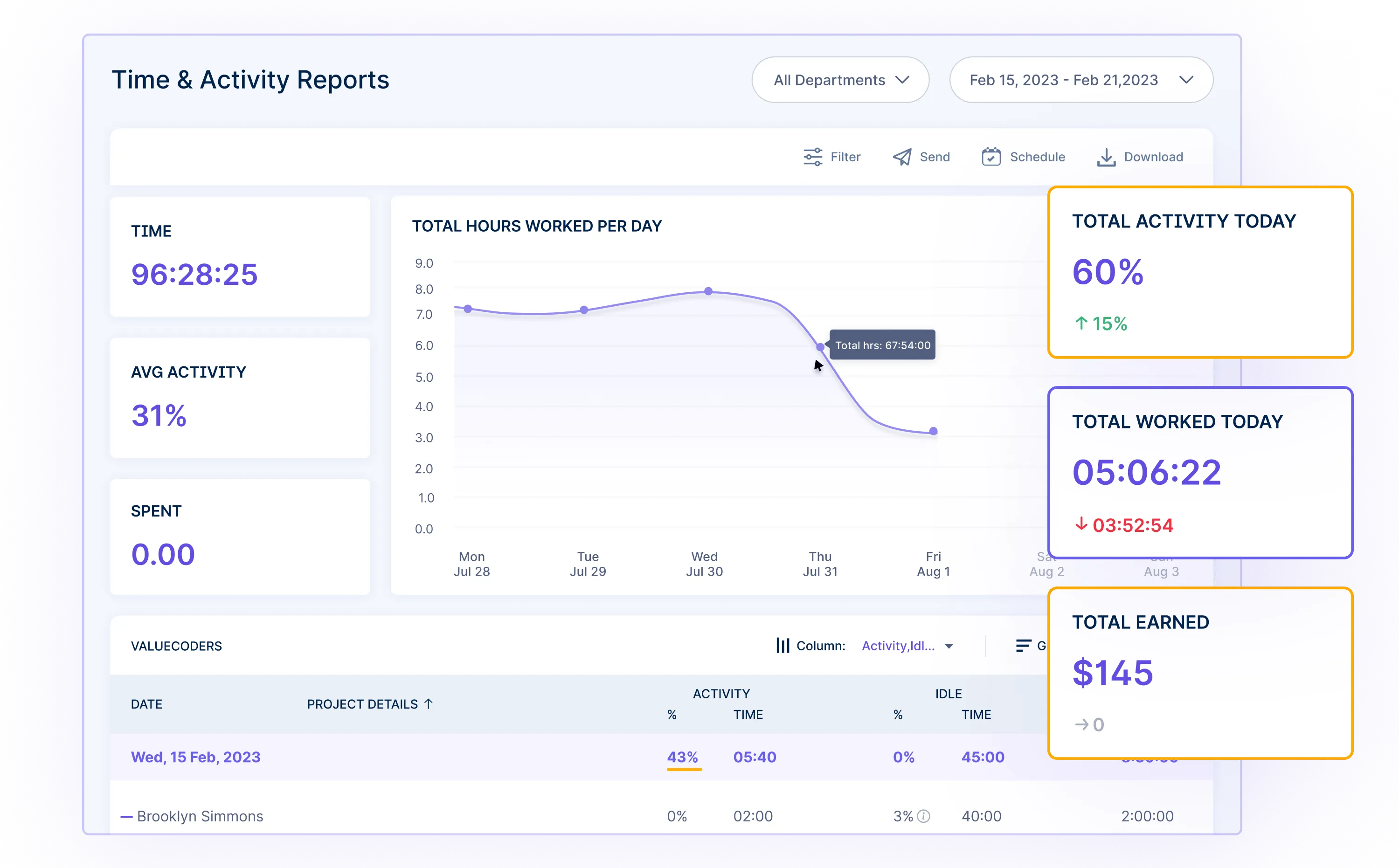

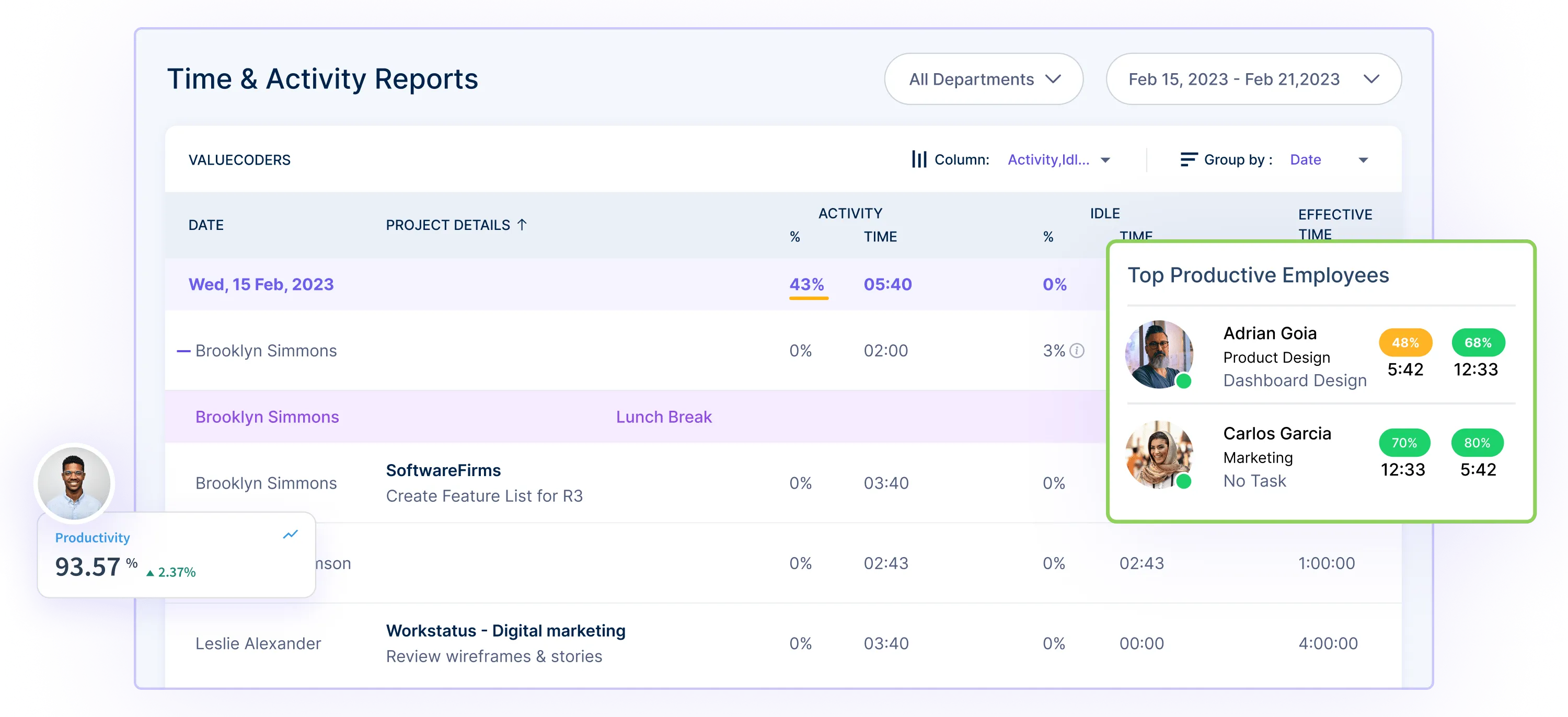

In the realm of compliance, data-driven insights are invaluable. Workstatus empowers you with robust reporting and analytics tools, enabling:

Detailed Timesheet Reports: Generate comprehensive reports to document compliance with labor laws.

Detailed Timesheet Reports: Generate comprehensive reports to document compliance with labor laws. Real-time Dashboards: Gain a live view of team activities, helping you address compliance issues promptly.

Real-time Dashboards: Gain a live view of team activities, helping you address compliance issues promptly.

Exportable Data: Easily export timesheet and compliance data for audits and recordkeeping.

Workstatus is a feature-rich platform that goes beyond basic time tracking, providing a comprehensive solution that facilitates timesheet compliance. It also enhances workforce management for businesses of all sizes and industries.

Conclusion

Timesheet compliance is a crucial workforce management component, requiring a clear understanding of legal obligations.

Compliance ensures fairness for employees and protects businesses from penalties.

With tools like Workstatus, companies can streamline compliance efforts, ensuring accurate time tracking and adherence to regulations.

Organizations can establish a strong foundation for regulatory adherence and effective workforce management by demystifying timesheet compliance.