Table of Contents

Introduction

Suppose it is July, and when you check your bank account, you realize there is an extra pay you did not get in June. You are receiving three paychecks instead of the two paychecks, as usual. This is what you get in the world of five paycheck months. If you are paid bi-weekly, some months fall on 24 instead of 26, meaning that you will have one extra day to save or spend.

In this blog, we will uncover the unique months in 2024 to 2029 where this financial bonus applies and how you can maximize these extra paychecks. It is crucial to understand and plan for these months because they will help you manage your expenses and realize greater returns on your investment and overall wealth.

In addition, we will also look at how you can use tools like Workstatus to take charge of this pay period and even forecast them for better finance and payroll management.

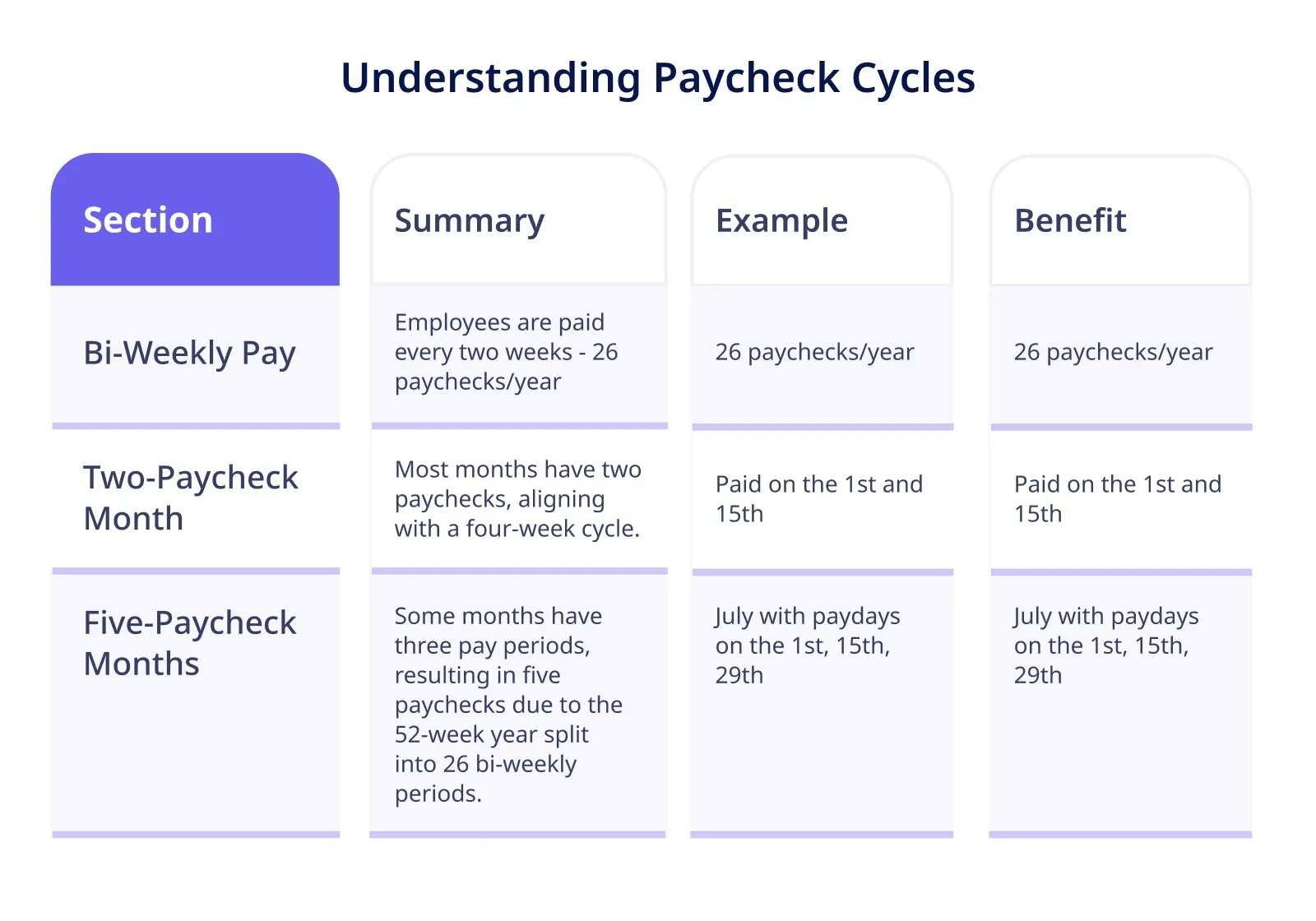

Understanding Paycheck Cycles

Bi-Weekly Pay Schedules

Bi-weekly payment systems are one of the most popular payment options that employers use. This system pays employees every 2 weeks in 26 paychecks per fiscal year. This predictability enables employees to budget their incomes because they know their salaries are paid at two-week intervals.

Two-Paycheck Month

In a typical month with a bi-weekly wage schedule, workers typically earn two paychecks. It also corresponds to the calendar months as most months are equal to four weeks. For example: If you are paid on the 1st and 15th of the month then you will have exactly two paychecks that will coordinate with the budgeting or paying the bills.

Five-Paycheck Months

However, since the calendar has additional paydays in some months, workers will receive five paychecks in each of these months. This case arises because there are fifty-two weeks in a year that is divided into 26 bi-weekly periods. The math works out such that some months will have three pay periods instead of the usual two in any given year, where there are 12 months in a given year.

These five paycheck months frequently occur twice a year and can be a great source of additional income. Deciding on these months beforehand gives you time to plan for and make the best use of the additional pay.

Five-Paycheck Months for 2024-2029

2024

Five-Paycheck Months:

- March

- May

- August

- November

Specific Dates of Paydays:

| March | 1st, 8th, 15th, 22nd, 29th |

| May | 3rd, 10th, 17th, 24th, 31st |

| August | 2nd, 9th, 16th, 23rd, 30th |

| November | 1st, 8th, 15th, 22nd, 29th |

2025

Five-Paycheck Months:

- January

- May

- August

- October

Specific Dates of Paydays:

| January | 3rd, 10th, 17th, 24th, 31st |

| May | 2nd, 9th, 16th, 23rd, 30th |

| August | 1st, 8th, 15th, 22nd, 29th |

| October | 3rd, 10th, 17th, 24th, 31st |

2026

Five-Paycheck Months:

- January

- May

- July

- October

Specific Dates of Paydays:

| January | 2nd, 9th, 16th, 23rd, 30th |

| May | 1st, 8th, 15th, 22nd, 29th |

| July | 3rd, 10th, 17th, 24th, 31st |

| October | 2nd, 9th, 16th, 23rd, 30th |

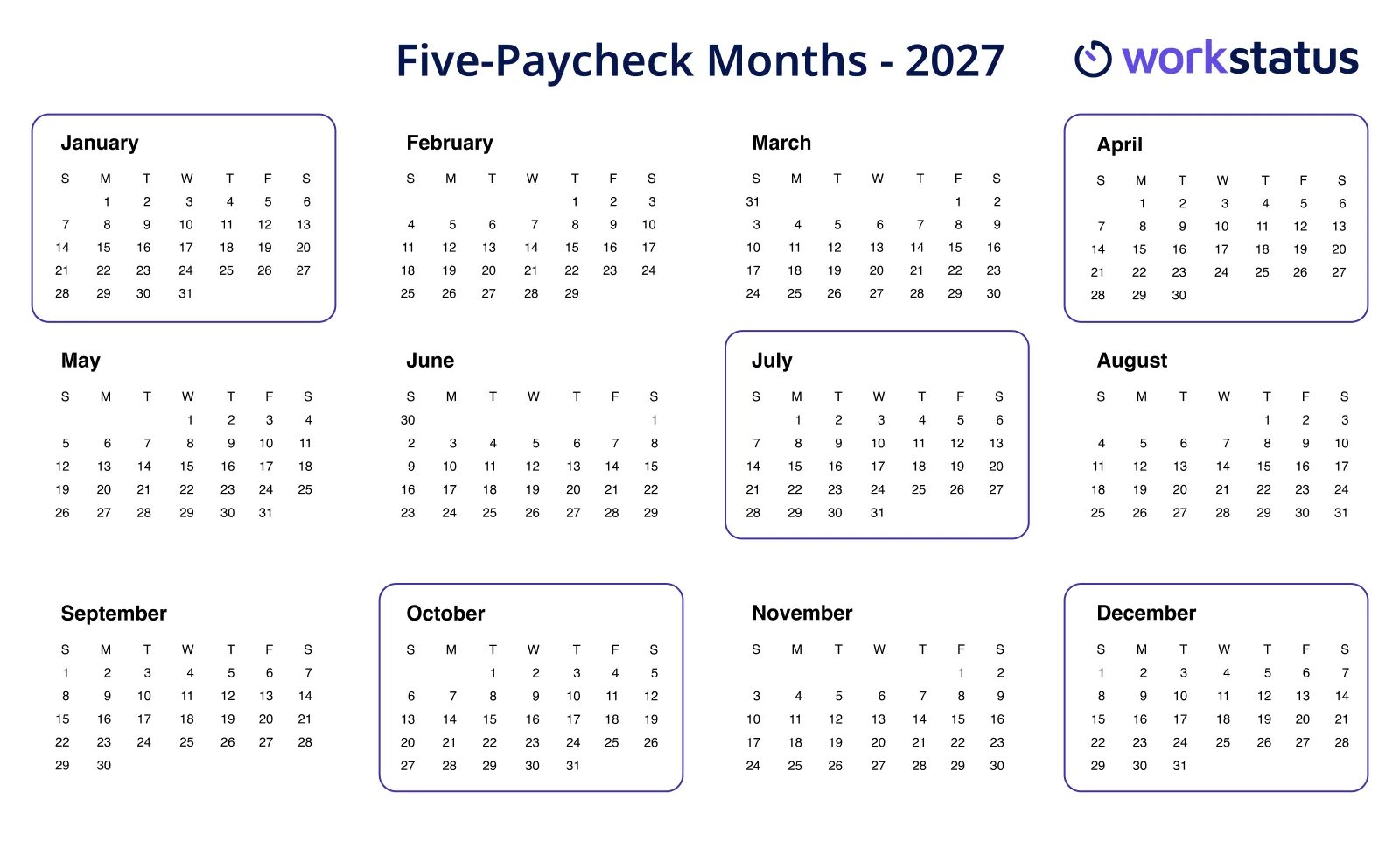

2027

Five-Paycheck Months:

- January

- April

- July

- October

- December

Specific Dates of Paydays:

| January | 1st, 7th, 14th, 21st, 28th |

| April | 2nd, 9th, 16th, 23rd, 30th |

| July | 2nd, 9th, 16th, 23rd, 30th |

| October | 1st, 8th, 15th, 22nd, 29th |

| December | 3rd, 10th, 17th, 24th, 31st |

2028

Five-Paycheck Months:

- March

- June

- September

- December

Specific Dates of Paydays:

| March | 3rd, 10th, 17th, 24th, 31st |

| June | 2nd, 9th, 16th, 23rd, 30th |

| September | 1st, 8th, 15th, 22nd, 29th |

| December | 1st, 8th, 15th, 22nd, 29th |

2029

Five-Paycheck Months:

- March

- June

- August

- November

Specific Dates of Paydays:

| March | 2nd, 9th, 16th, 23rd, 30th |

| June | 1st, 8th, 15th, 22nd, 29th |

| August | 3rd, 10th, 17th, 24th, 31st |

| November | 2nd, 9th, 16th, 23rd, 30th |

By tracking these months and their specific pay dates, you can strategically plan your finances to take full advantage of the extra income during these five paycheck months.

Impact Of Five Paychecks On Employer

Five paycheck months can provide great benefits to employees but also pose distinctive challenges to employers. It is necessary to learn about and plan for these months to avoid complications in payroll management and financial stability. undefined

Increased Payroll Budget Requirements

Business owners need to make sure that their business is financially able to meet the extra payments during the five paycheck months. This calls for thorough financial budgeting to cater to the additional expenditure without overstretching the business finances or operations.

Payroll Processing and Administrative Workload

A five-paycheck month means more administrative work especially in the payroll department due to an additional payroll cycle. This includes calculation of additional paychecks, providing for accuracy of all calculations, and dealing with possible issues. Such employers may have to allocate more time and effort to manage the higher demand effectively.

Impact on Benefits and Deductions

Many benefits and deductions are paid out on a monthly basis; such can include health insurance premiums or retirement contributions for example. In five-paycheck months, the employer must ensure that these deductions are applied across five of the pay periods, which may mean adjusting the amount removed in each paycheck to achieve the desired level of deductions.

Employee Communication and Expectations

Interfacing with employees is essential during the five paycheck months. Agencies should communicate to employees about an additional check and any possible changes in their benefits or deductions as well as an additional tax withholdings. It helps employees to have set expectations and avoids confusion and miscommunication.

Cash Flow Management

Five-paycheck months may also place pressure on an employer’s cash flow of a small business that lacks a buffer fund. Companies need to carefully control their cash flow and make sure they have enough to cover payroll and keep other budgets on track.

Strategic Financial Planning

Some employers may view the occurrence of five paycheck months as an opportunity to plan better. These months can be predicted months in advance, and then employers can accrue finances, allocate budgets to ensure financial stability, and make any necessary changes.

Employers can reap many benefits from using advanced payroll management tools such as Workstatus. These tools can process payroll, generate audit reports for payroll cycles, and predict five paycheck months. Some features, such as automated notifications and extensive reporting, can help improve payroll workflow and improve the accuracy and efficiency of the process.

What Happens When You Get an Extra Paycheck?

Getting five paychecks in a month is only possible for employees who get paid weekly. These extra weeks in certain months affect different payroll schedules in different ways. Let’s break it down for the most common schedules.

- If you get paid every two weeks (bi-weekly): As the name suggests, bi-weekly payroll means you get paid every two weeks. But, in the event of a five-week month, sometimes you’ll receive three paychecks. This happens a few months a year when your payday falls on the first Friday of a month with five Fridays. If your first payday falls on the second Friday of those months, you won’t get a third paycheck.

- If you get paid twice a month (semi-monthly): Employees on a semi-monthly schedule receive two paychecks each month. A five-week month means you work more days. To account for this, you’ll still receive your usual two paychecks, but one or both of them will be larger.

- If you get paid monthly: The impact is more subtle for those on a monthly pay schedule. While your monthly income remains the same, you may need to stretch it further to cover the additional week’s regular expenses.

How To Maximize Five Paycheck Months?

Five paycheck months present a once-in-a-lifetime opportunity for building wealth and saving faster. It is possible to use the additional income from these months to help you realize your financial goals. Here are some effective ways to maximize five-paycheck months:

Budgeting and Savings

A five-paycheck month is a great opportunity to plan ahead for fuller financial abilities out of the additional paycheck. There are situations when you can spend the additional funds to tackle your financial goals strategically. This is because by putting the bulk of your savings into these months, you will be able to have a robust financial structure to handle

Debt Repayment

Another good method is to apply the extra income to reduce debts faster. Whatever this extra income is, such as credit card debts, student loans, and so on, using it to pay down debts means the debts will be paid at a faster pace and their interests reduced. It is important to prioritize larger debts to maximize the effect of payments and become debt-free faster.

Financial Goals

Five paycheck months also offer an opportunity to achieve certain goals in the budget. The extra money will help you to achieve these goals in less time whether you want to put a deposit on a house or save for a holiday or retirement. You may consider setting up auto-debits to your investment accounts or opening a separate account for your savings.

Leverage Workstatus for Efficient Payroll Management

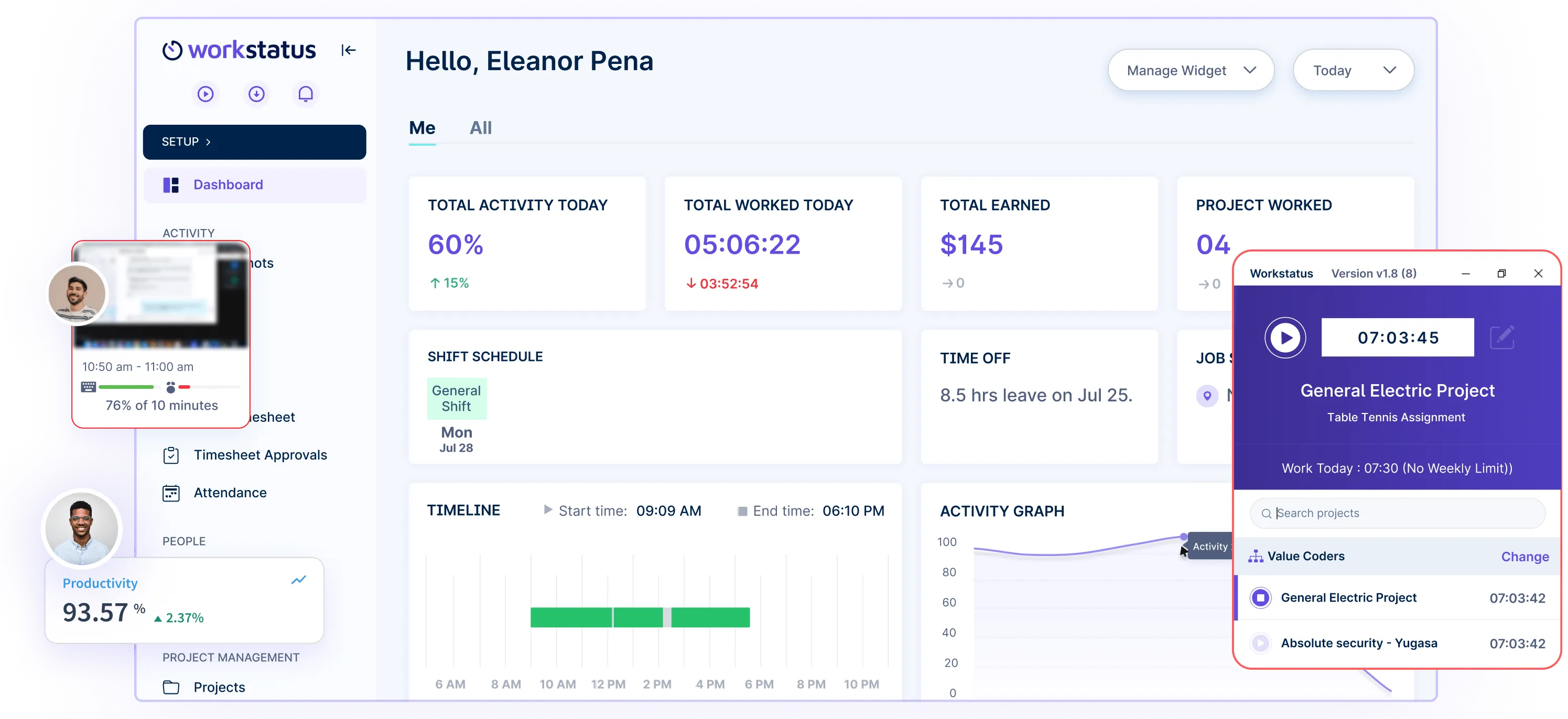

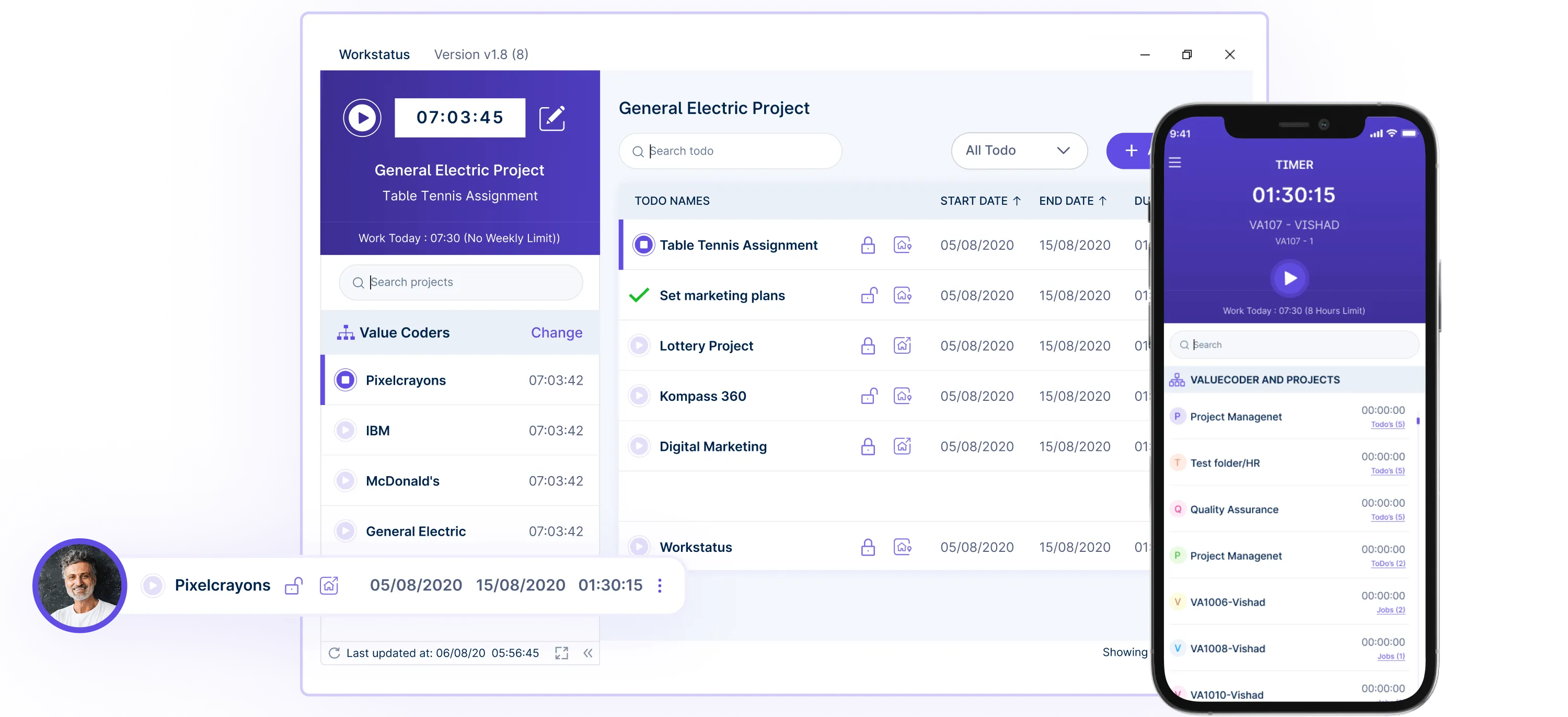

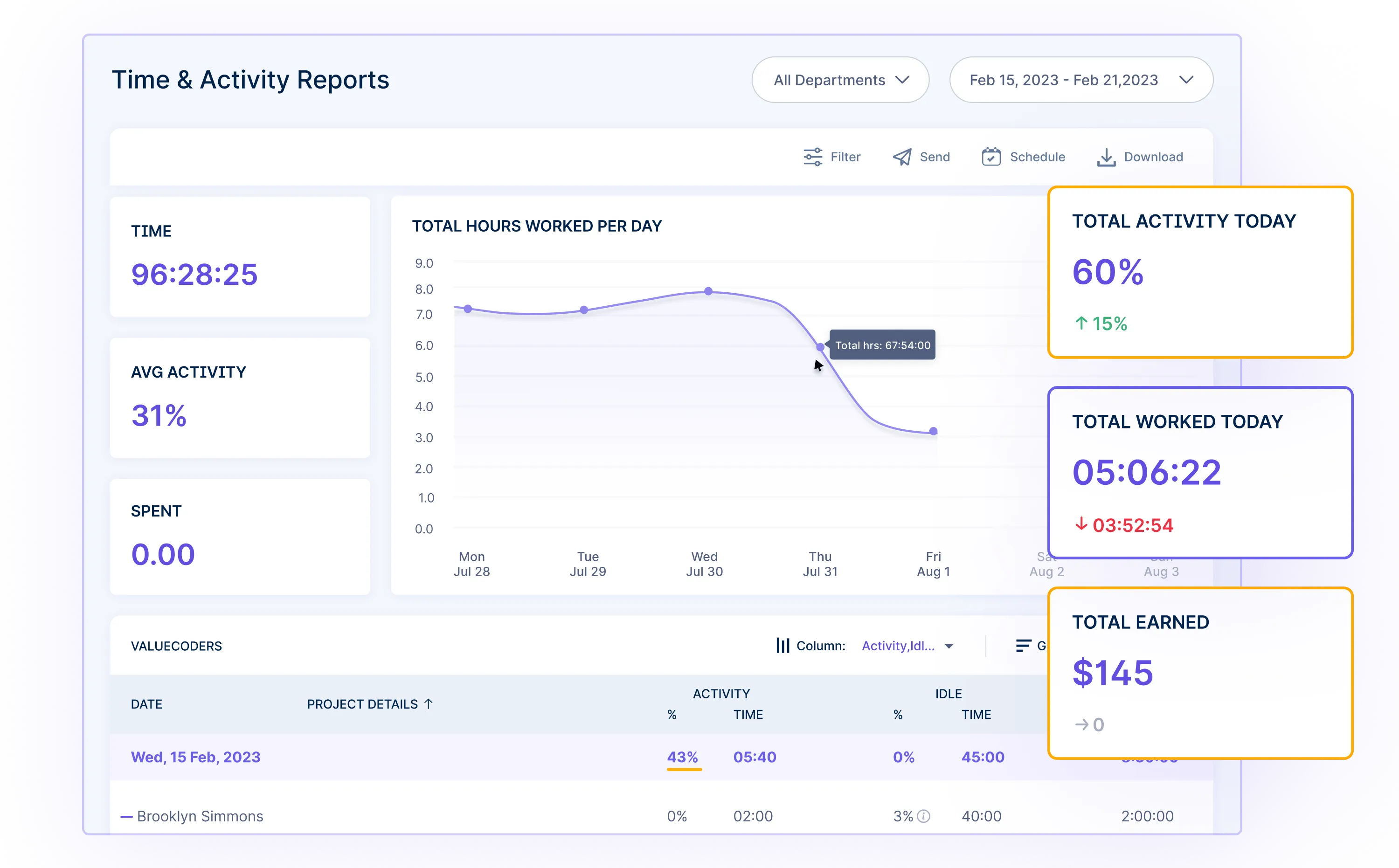

Workstatus is a workforce management software product that helps streamline employee payroll, scheduling, and other processes. Here’s an overview of Workstatus and its functionalities, along with how it can assist in identifying and managing five paycheck months:

Overview

Workstatus is an advanced software designed to assist various businesses to manage their manpower well. It can perform tasks such as employee time tracking and payroll processing that are performed by the HR or administrative personnel and saves time. Operating with an intuitive interface and advanced settings, Workstatus is suited for various sectors and businesses.

Features That Assist in Identifying Five-Paycheck Months

- Real-time Tracking of Pay Periods: Workstatus allows employers to track pay periods with ease in real-time to determine the number of hours worked by their employees. This visibility also helps in planning and predicting what the company is going to spend on payrolls.

- Automated Notifications for Five-Paycheck Months: Workstatus informs employers or administrators when employees are entering five-paycheck months. This feature helps generate timely information and enables businesses to manage project budgets and resources as required.

- Detailed Reporting and Analytics: Workstatus offers the complete reporting and analysis solution which provides information on payroll trends, employee productivity, and labor costs. Employers can explore hiring trends, capacity planning, and even cost-cutting opportunities using this data.

Conclusion

Five paycheck months represent a time of financial opportunity for both employees and employers. These months come around 8% of times in a year and earn one an extra salary due to the special months.

For employees, the optimal use of these months includes personal budgeting and debt repayment, as well as individual goal setting. By earning and using this extra income, one can increase savings or repay debts within a shorter period, thus enhancing financial status.

The five-paycheck months also bring about challenges such as high payroll budget needs and administration time. However, with tools such as Workstatus, organizations can help make the payroll process faster and easier to perform.

In closing, every person has to acknowledge the presence of five-paycheck months and develop ways of handling them. It means that during these periods of time people can reach their financial targets faster and businesses can make their payroll and work financially stable. With the right mindset and proper technical infrastructure focused on these opportunities in place, everyone can benefit from these opportunities.

FAQs

Q. How does a five-paycheck month affect my tax withholdings?

Ans. With an extra paycheck, you may have more taxes withheld from your paychecks during that month. However, this should balance out over the year, and you won’t necessarily owe more in taxes overall.

Q. Will my employer adjust my deductions for benefits like health insurance?

Ans. Typically, employers will spread out the deductions for benefits over the five paychecks in that month, so the total deduction amount remains the same as a regular month.

Q. Do salaried employees also get impacted by five paycheck months?

Ans. For salaried employees, there’s usually no impact since their pay remains the same each month regardless of the number of pay periods.