Table of Contents

Managing audits, tax filings, and client requests can be overwhelming—but effective project management changes everything.

With the right tools, you can meet deadlines, stay organized, and keep clients happy—no more late-night stress over missing spreadsheets! The global project management software market was estimated to be worth USD 6.59 billion in 2022.

It will expand at a compound annual growth rate (CAGR) of 15.7% from 2023 to 2030. As project management software demand grows, accounting firms must embrace solutions that boost efficiency and client satisfaction.

Alright, let’s dive into the fundamentals of project management software for accounting firms: practical, effective, and with just a touch of flexibility.

Who wouldn’t want their firm to operate efficiently like a perfectly synchronized machine?

Common Project Management Challenges and Solutions

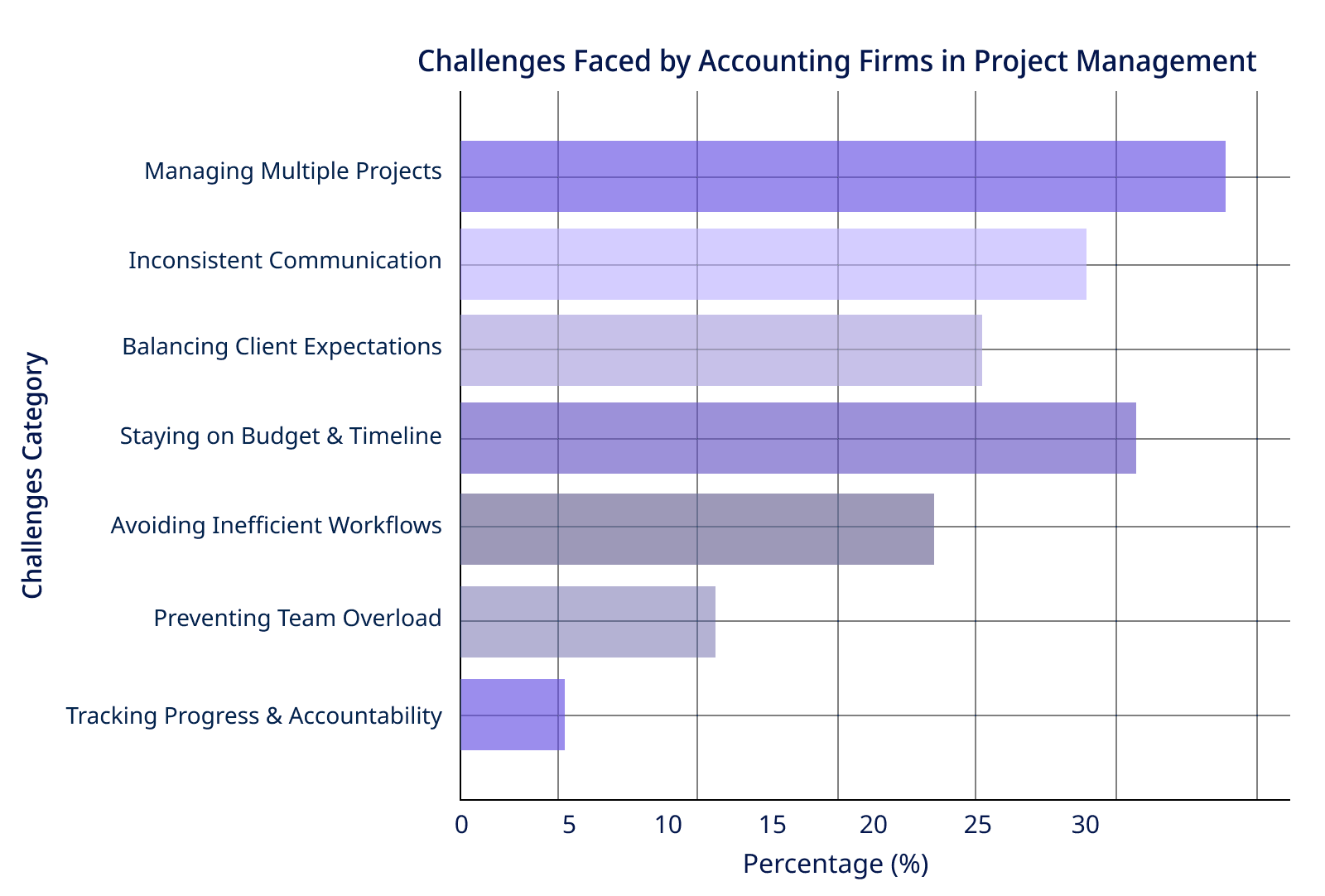

Here are the standard project management challenges and solutions for accounting firms:

Here are the standard project management challenges and solutions for accounting firms:

Managing Multiple Projects

- Challenge: With audits, tax returns, and other events simultaneously, tasks can slip through the cracks.

- Solution: Use project management software for accounting firms to prioritize, assign tasks, and set precise due dates. Tools like Workstatus help you track everything at a glance.

Inconsistent Communication

- Challenge: Miscommunication between clients and team members leads to rework and delays.

- Solution: Create a communication plan and use a single platform for team and client updates. Weekly check-ins keep everyone aligned.

Balancing Client Expectations

- Challenge: Clients often expect their needs to come first, leading to stress and burnout.

- Solution: Define milestones and timelines upfront and provide regular updates to inform clients and prevent surprise requests.

Staying on Budget and Timeline

- Challenge: Scope creep and delays can throw off budgets and timelines.

- Solution: Set a clear scope and budget and manage changes by adjusting fees or timelines when clients add new requests.

Avoiding Inefficient Workflows

- Challenge: Manual, repetitive tasks slow things down.

- Solution: Automate where possible—use templates, automated reminders, and accounting software to reduce admin time.

Preventing Work Overload During Peak Seasons

- Challenge: Busy seasons can lead to burnout and lower work quality.

- Solution: Plan with temporary help or staggered schedules, and use time-tracking to distribute tasks evenly.

Tracking Progress and Accountability

- Challenge: Without clear ownership, tasks get missed, and deadlines slip.

- Solution: Use project management software for accounting firms to assign tasks and track progress, making it easy to see who’s doing what.

With these solutions, accounting firms can keep projects organized and on time and smoothen client relationships—even during the busy season.

How Workstatus Can Empower Accounting Firms?

Workstatus is the best project management software for accounting firms that enhances productivity and streamlines operations for accounting firms.

With features like time tracking, task monitoring, expense management, and detailed reporting, it helps firms track billable hours, meet deadlines, and stay within budget—keeping clients satisfied and projects on track.

Here are the key features of Workstatus that can help accounting firms:

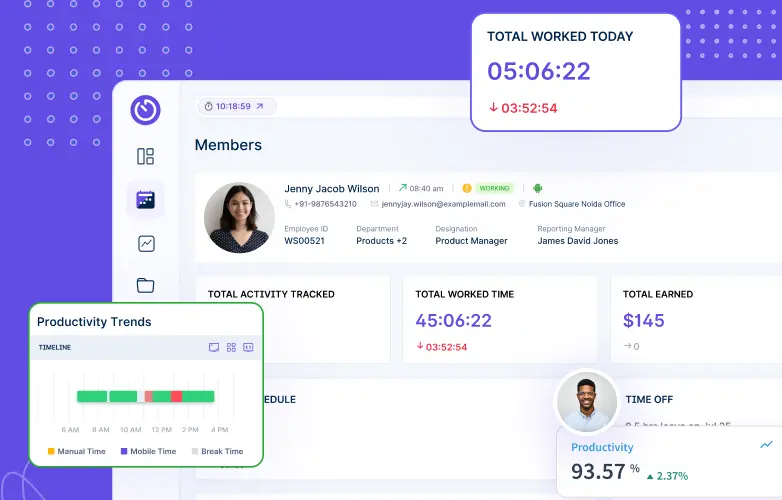

Time Tracking and Timesheet Management

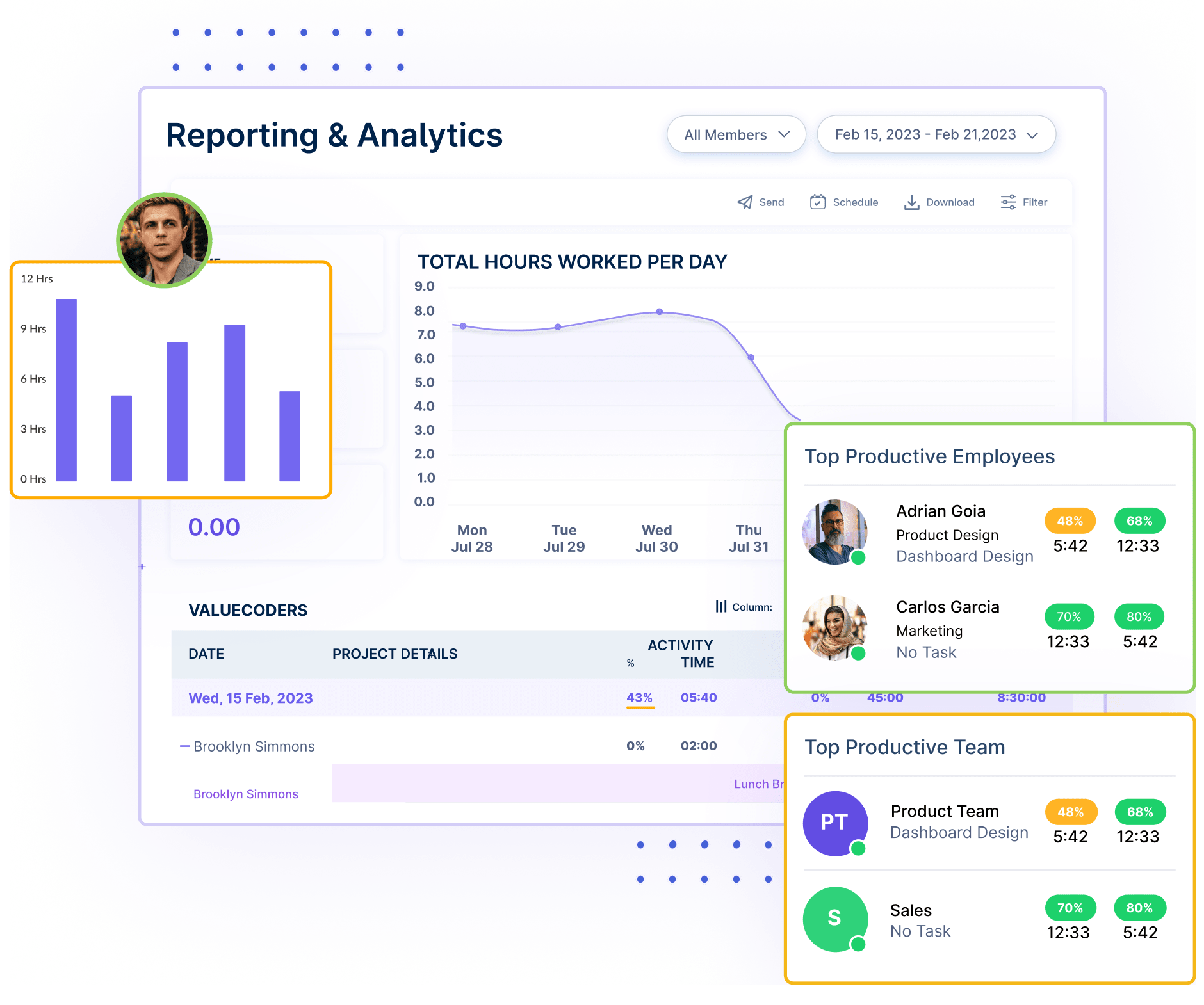

![]() As the best project management software for accounting firms, Workstatus makes tracking employee hours easy and accurate. Accountants can log hours spent on various clients or tasks, creating a reliable record for billing and productivity insights.

As the best project management software for accounting firms, Workstatus makes tracking employee hours easy and accurate. Accountants can log hours spent on various clients or tasks, creating a reliable record for billing and productivity insights.

Automated timesheets streamline payroll and client invoicing, reducing manual entry errors and ensuring accurate billing for every project.

Also read: Best Microsoft Project Alternatives Tools

Real-Time Project and Task Monitoring

With real-time project monitoring, accounting teams can see the status of each task at a glance.

With real-time project monitoring, accounting teams can see the status of each task at a glance.

Workstatus helps managers track progress, identify potential bottlenecks, and reallocate resources. This feature ensures that projects stay on schedule, improving accountability and transparency across the team.

Expense Tracking and Budgeting

![]() Expense tracking within Workstatus allows firms to monitor project budgets in real time, keeping expenses aligned with client budgets and financial targets.

Expense tracking within Workstatus allows firms to monitor project budgets in real time, keeping expenses aligned with client budgets and financial targets.

Teams can log expenses for individual projects, helping managers keep budgets on track and giving clients a clear view of project costs.

Customizable Reports and Analytics

Workstatus offers customizable reports that provide valuable insights into productivity, project timelines, and profitability.

Workstatus offers customizable reports that provide valuable insights into productivity, project timelines, and profitability.

With detailed analytics, accounting firms can assess time spent on different activities, measure billable vs. non-billable hours, and make data-driven decisions to optimize team performance.

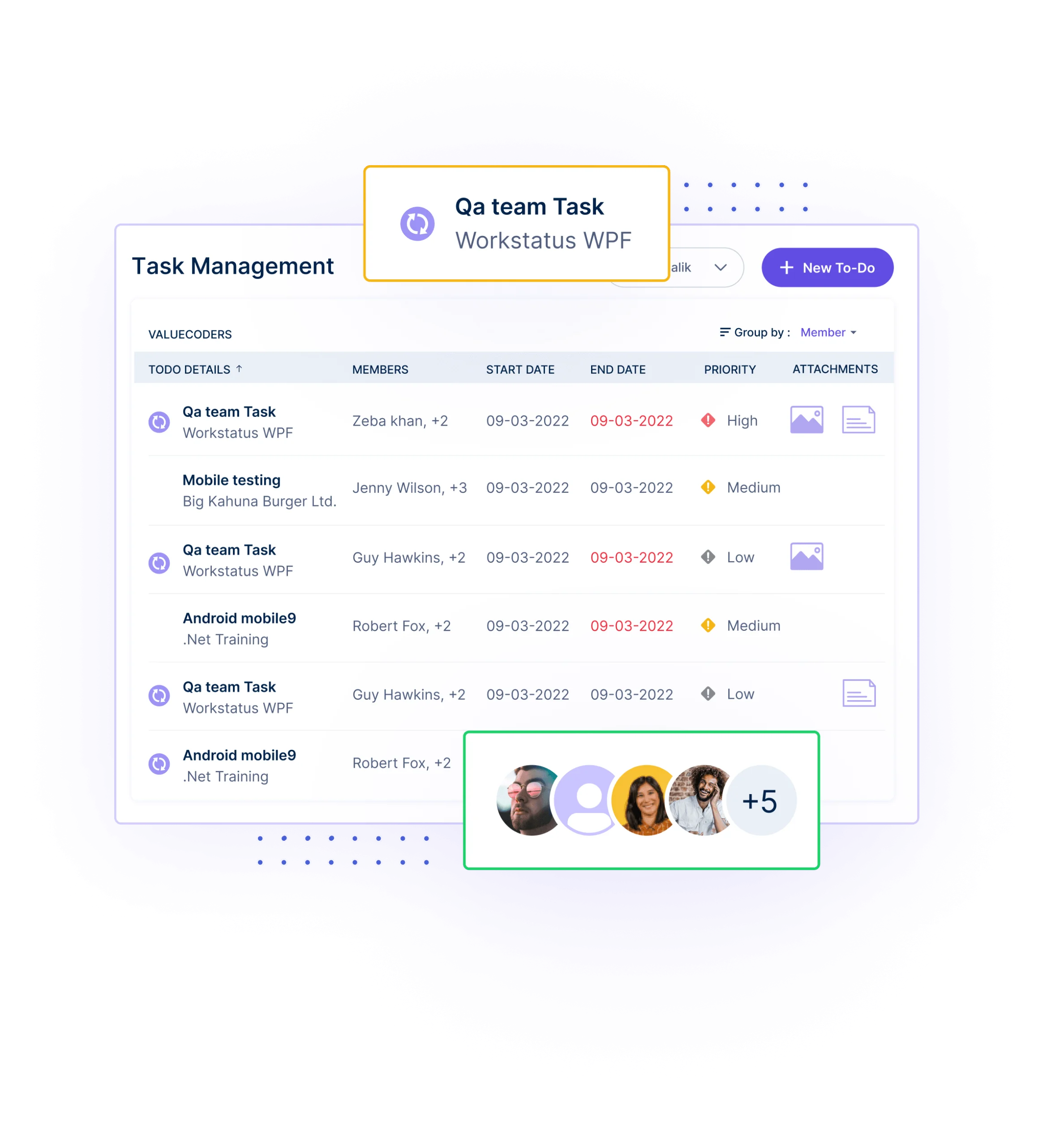

Task Prioritization and Deadline Management

Efficient task management is crucial in accounting, where deadlines are non-negotiable. Workstatus allows managers to assign and prioritize tasks based on urgency and workload, helping the team meet deadlines consistently.

Efficient task management is crucial in accounting, where deadlines are non-negotiable. Workstatus allows managers to assign and prioritize tasks based on urgency and workload, helping the team meet deadlines consistently.

Notifications and reminders help team members stay on top of tasks, minimizing delays and improving overall workflow efficiency.

Also read: Best Microsoft Planner Alternatives Tools

Core Project Management Principles for Accounting Firms

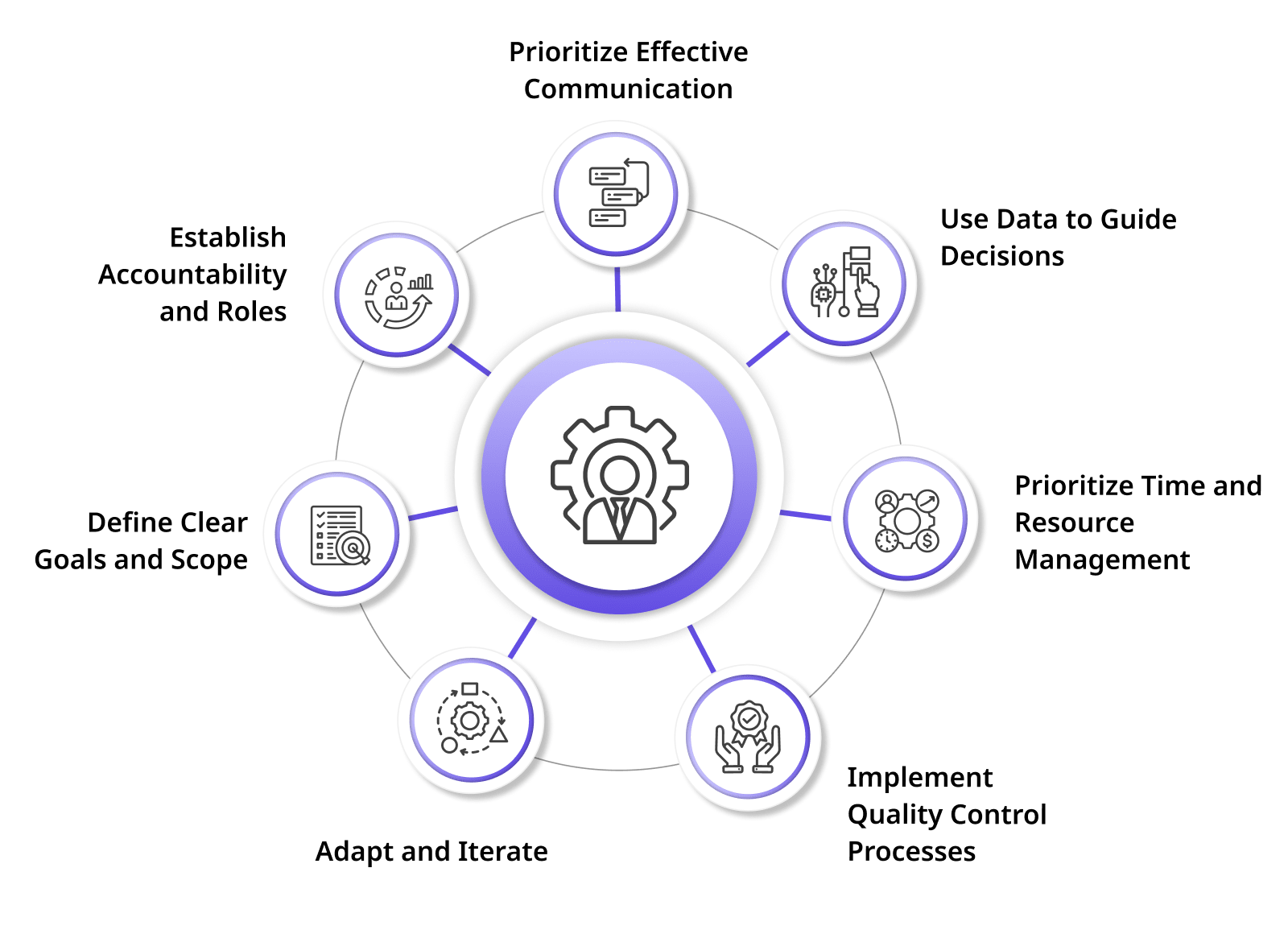

Here are the core project management principles for accounting firms:

Here are the core project management principles for accounting firms:

Define Clear Goals and Scope

Successful projects start with clarity. Before work begins, define the project’s scope, goals, deliverables, and timeline.

By knowing precisely what’s in and out of scope, your team can avoid “scope creep” and manage client expectations effectively. This will set a solid foundation and help avoid surprises.

Establish Accountability and Roles

Each team member should know exactly what they’re responsible for. Assign roles and tasks clearly, whether handling client communication, managing data, or reviewing financial statements.

Reliable project management software for accounting firms can help assign tasks and deadlines, ensuring accountability and preventing tasks from being overlooked.

Prioritize Effective Communication

Consistent and clear communication keeps both the team and clients aligned. Set up regular check-ins, use a unified platform for updates, and maintain an organized document-sharing system.

This makes it easy for everyone to stay informed and reduces misunderstandings that can lead to rework or delays.

Also read: Best Teamwork Alternatives Tools

Use Data to Guide Decisions

In accounting, data is everything. Track project metrics, such as hours spent, budget adherence, and progress toward milestones, to evaluate where things stand.

Use this data to make adjustments in real-time. This data-driven approach supports better decision-making, leading to more efficient projects.

Prioritize Time and Resource Management

Accounting teams often face crunch times during tax season or audit periods, so careful resource planning is critical.

Use project timelines to map out peak workload periods and assign resources accordingly. This way, the team isn’t overextended, and work quality stays consistent, even in busy seasons.

Implement Quality Control Processes

Accuracy is critical in accounting. To prevent errors, ensure every project includes quality checks at each phase.

To maintain quality and consistency, use standardized checklists, peer reviews, or automation tools. This approach reduces the risk of costly mistakes and builds trust with clients.

Adapt and Iterate

Projects rarely go exactly as planned, so flexibility is essential. Use a project management approach, like agile, that allows for adjustments.

Review what’s working and where improvements are needed regularly, then tweak processes and workflows. This adaptability makes the team more resilient and prepared for unexpected challenges.

Adopting Technology for Streamlined Operations

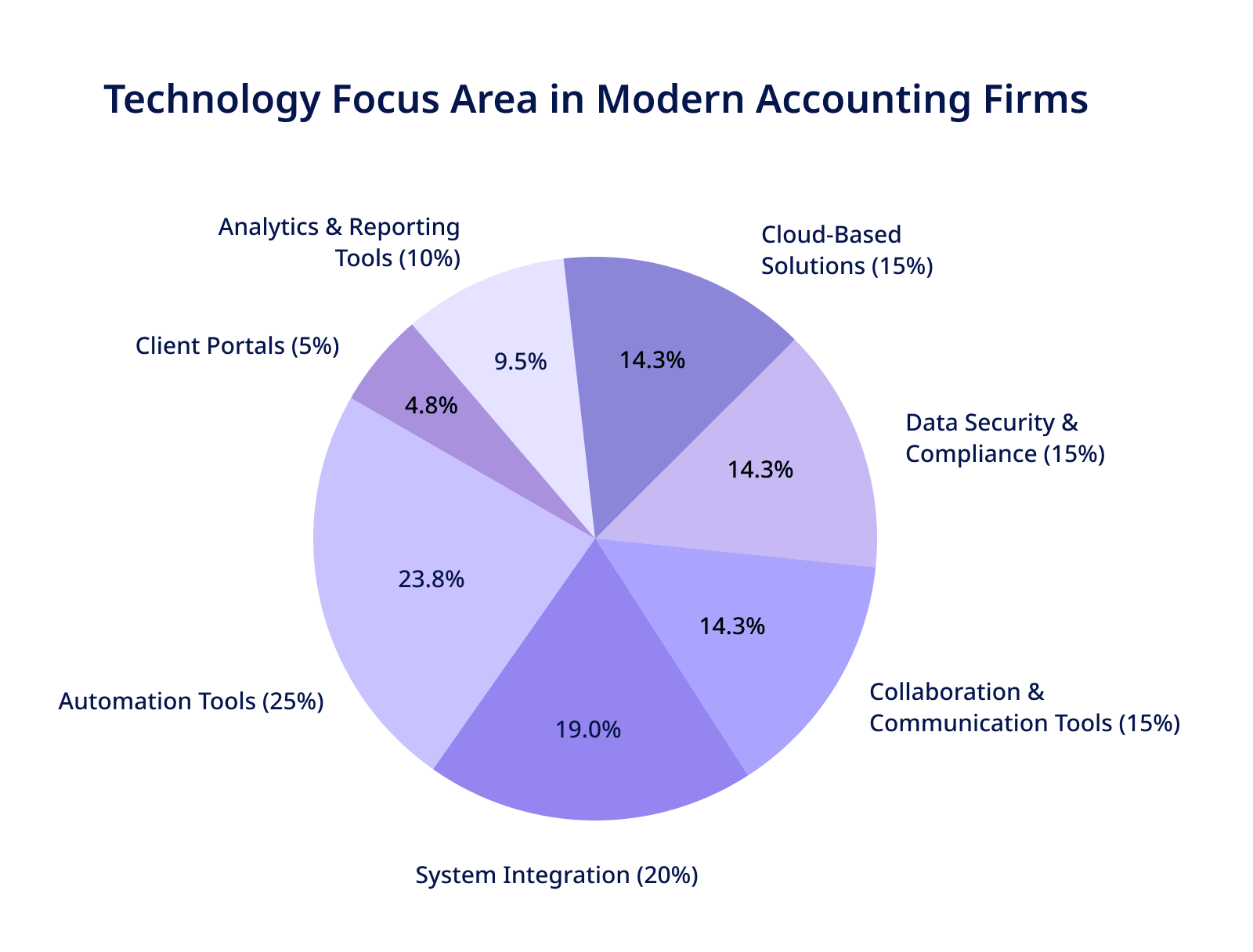

Only a few organizations fully understand the value of project management. Here are some of the latest technologies accounting firms should adopt to streamline operations:

Only a few organizations fully understand the value of project management. Here are some of the latest technologies accounting firms should adopt to streamline operations:

Automating Repetitive Tasks

Let’s face it—nobody gets excited about endless data entry or cranking out invoices. Thankfully, technology can take those mind-numbing chores off your plate.

Automation tools handle tasks like data entry, invoicing, and report generation with ninja-like precision. That means fewer errors and more time for you to shine on the strategic stuff—like saving your client’s bacon during tax season.

Integrating Systems for Efficiency

Running an accounting firm with disconnected software tools is like trying to assemble IKEA furniture without instructions—chaotic and error-prone.

System integration smooths data flow, reduces manual work, and minimizes mistakes. With cloud-based platforms, your team can access real-time information from anywhere, making decision-making (and teamwork) a breeze.

Collaboration and Communication Tools

Managing multiple client projects is tricky enough without playing a game of “Where’s That Email?” Enter tools like Microsoft Teams or Workstatus: they keep communication sharp, tasks organized, and files right where you need them.

These tools keep everyone in sync—even if your time zones differ- remote or across the office.

Data Security and Compliance

Keeping client data safe isn’t just good practice; it’s survival in accounting. Encrypted storage and secure file-sharing tools are like having a digital Fort Knox.

Plus, many project management platforms are compliance wizards, so you’ll always stay one step ahead of changing regulations—without breaking a sweat.

Cloud-Based Solutions

Cloud-based tools make your firm 21st century compliant (at last!). From the sunny shores to the dull cubicle, you can update client info and deadlines and make things move in real-time.

Bonus? The files are automatically backed up, so the frantic search for a lost file ceases. Crisis averted!

Analytics and Reporting Tools

There are no more assumptions about how your projects are performing. With the help of advanced analytics, you can monitor KPIs such as timelines, budgets, and resources used with great precision.

Imagine being able to look through the body of your firm—the ability to identify areas for change that are, for all intents and purposes, invisible yet critical to your success.

Client Portals for Easy Access

Forget about countless exchanges in the mail chains and meet our modern and safe client spaces.

Documents can be uploaded; project progress can be viewed without dealing with the back and forth of the inbox. It is quicker and more straightforward, and you can run about as if you know how all these computer things work.

These tools do more than improve efficiency at your practice—they allow you to concentrate on what matters: happy clients and sane employees.

Closing Thoughts

And there you have it—Project Management Essentials for Modern Accounting Firms. Organizations that consistently use project management practices have a 92% success rate in meeting project objectives.

While it may not deliver the thrill of balancing a T-account or the satisfaction of uncovering an unexpected tax deduction, project management is at the core of a profitable and well-coordinated accounting firm.

Think of it this way: with goals set, communication lines opened, time management strategies in place, and proper use of appropriate tools and technologies, not only are projects on track, but your sanity and work-life balance can also be partly recovered.

By integrating these strategies into your everyday business, disorderly tax season becomes a harmonious presentation, clients are delighted, and stress due to tight deadlines is manageable.

So, here’s to streamlined workflows, satisfied clients, and a smooth tax season ahead—cheers to running your firm with the precision of a fine timepiece (and to fewer late-night coffee runs!).

FAQs

Ques. Why is project management important for accounting firms?

Ans. Project management ensures that tasks stay organized, deadlines are met, and client expectations are managed effectively. It helps improve productivity, reduces errors, and ultimately increases profitability.

Ques. How can project management improve client satisfaction?

Ans. By keeping projects organized and on time, project management helps ensure transparency and consistent communication with clients, which builds trust and enhances satisfaction.

Ques. How do accounting firms handle peak workload seasons with project management?

Ans. During peak seasons, project management helps with resource allocation, task prioritization, and deadline management, ensuring that work is completed efficiently without overwhelming the team.