Table of Contents

Introduction

As business leaders, you must understand the pivotal role of compensation policies in fostering employee morale, work performance, and overall satisfaction within the company.

In today’s business management approach, fair compensation for employees’ extra time and effort is a prominent aspect that continuously demands attention. Especially, during peak work times when employers ask their employees to work beyond regular hours.

Did You Know?

About 78% of workers are eligible for overtime pay, and about 40% of workers among them are eligible for double-time pay rates under certain circumstances.

Managers and CEOs must recognize their employees’ valuable contributions, especially during critical times and demanding circumstances. It’s your responsibility to ensure that your company’s compensation policies align with your organizational values and objectives.

Most importantly, offering double-time pay shows your commitment to fair labor practices, employee work-life balance & well-being, and promoting a workplace culture of appreciation, trust, and respect.

In this blog, we will delve into the realm of double-time pay. From learning what it is, and when it applies to understanding how it’s calculated and ensuring compliance with regulation, we’ve covered it all!

Let’s unravel the mystery behind double-time pay.

Understanding Double Time Pay

Doube-time pay is a type of overtime pay that includes paying out overtime hours at twice an employee’s regular rate. It’s typically for employees who work beyond their regularly scheduled shifts. It includes national holidays, overnight shifts, or days when your business is normally closed.

For instance, Sahil might be eligible for double-time pay if he works a less desirable shift, is on a holiday, or does an extra amount of overtime.

Moreover, double-time pay is usually mandated through labor laws or collective bargaining agreements. Some businesses usually use this as compensation for an extra or unusual request for an employee’s time and commitment. There are multiple tools like Workstatus that help record and calculate double-time pay with ease.

Thus, understanding double-time pay is required to ensure fair compensation, legal compliance, and transparency in the workplace. Employers and employees should familiarize themselves with applicable labor laws, company policies, and industry standards to ensure equitable treatment and compliance with regulatory requirements.

When is Double Time Pay Used?

Double-time pay is added to the workplace by employers when an employee has truly gone the extra mile in his workday. It’s basically a special bonus, a recognition of those times when employees put in the additional effort that goes beyond the norm.

Here are typically two work conditions when double-time pay is applied:

- Work More Than 12 Hours a Day: Normally, employees are eligible for double their normal pay rate for any time they spend working after the 12-hour mark. It’s imperative to know that some employees have already started earning overtime after working 8 hours a day.

- Work Seven Days in a row within a Single Pay Period: Employees should avail double-time pay after working 8 hours on the 7th day.

However, it all majorly depends on different factors, including laws and the company’s policy on who is considered exempt and nonexempt.

Factors Affecting Double-Time Pay Rates

Here are some key factors affecting double-time pay rates:

1) Employer Policies: The first factor to consider is the employer’s policies. Most companies follow a bunch of rules about when double time kicks in, whether after a specific number of hours worked in a day or week or during certain times such as holidays or weekends. So, checking a company’s guidelines is crucial to know when an employee is eligible for that extra payout.

2) Employment Contracts: An individual employment contract or agreement may also affect the double-time pay rates. Most contracts might review certain terms on overtime and double time, including rates and circumstances for eligibility. That’s why ensure to check the contract to understand the rights and entitlements.

Read More: Why & How to Monitor Employee Web Usage?

3) Industry Standards: Believe it or not, several industries have different standards for double-time pay. Some jobs with round-the-clock coverage, such as healthcare or emergency services, might offer more generous double-time rates to encourage employees to work during off-hours.

4) Company Culture and Practices: Last but not least, company culture and practices can directly impact double-time pay rates. Most employers may offer generous compensation packages to attract and retain top industry talent, including higher double-time rates.

5) Shift Differentials: A few employers provide shift differentials, which are extra compensation rates for working certain shifts, like evenings, nights, or weekends. Moreover, these shift differentials may be added to double-time pay calculations, increasing the compensation rate.

6) Legal Requirements: One of the most important factors impacting double-time pay rates is usually legal requirements stated by labor laws and regulations. These laws may direct when double-time pay applies, like on holidays or beyond a specific number of hours in a workday or workweek.

7) Employee Classification: The classification of employees may impact double-time pay rates. For instance, non-exempt employees, who are normally eligible for overtime pay, may avail different double-time rates compared to exempt employees, who are not eligible for overtime under specific circumstances.

Why Should You Calculate Double Time Pay?

Here are some relevant reasons why calculating double-time pay is essential:

1) Fair Compensation: One of the key reasons to calculate accurate double-time pay is to compensate employees fairly for working beyond traditional working hours like holidays, weekends, or exceeding certain thresholds. By doing so, employers acknowledge and appreciate the extra effort and commitment put in by employees during additional working hours.

2) Retention and Loyalty: Providing fair compensation to employees, like double-time pay, leads to higher employee retention rates. Employees who are fairly compensated and appreciated for their work and efforts are more likely to stay loyal to the company and contribute to its long-term success.

3) Legal Protection: Accurate calculation of double-time pay offers legal protection to employers by documenting compliance with labor laws and regulations. During audits, investigations, or legal disputes, thorough record-keeping of double-time pay calculations can help defend against any claims of unpaid wages or labor law violations.

4) Employee Morale and Engagement: Adding fair and transparent compensation practices, like double-time pay, increases employee morale and engagement. When employees are valued and adequately compensated for their work, they will likely stay motivated, productive, and dedicated to the company for the long term.

5) Competition and Recruitment: Employers who provide fair and competitive compensation packages, like double-time pay, are better positioned to attract and retain top talent in the industry. A reputation for fair compensation practices boosts the employer’s brand and differentiates the company from several competitors in the industry.

6) Legal Compliance: Normally, the government has certain labor laws and regulations directing overtime compensation, including double-time pay rates and eligibility criteria. By accurately calculating double-time pay, employers ensure compliance with these laws, mitigating the risk of legal disputes, penalties, or non-compliance issues.

7) Transparency and Trust: Correctly tracking the working hours and calculating double-time pay encourage transparency and trust in the workplace. Most employees appreciate clear and consistent compensation practices, resulting in a healthy and positive work environment and stronger employee-employer relationships.

Thus, by following transparent and equitable compensation practices, businesses are committed to supporting a positive work culture and achieving their business goals effectively.

Read More: Calculating & Managing Billable Hours in Business

Methods to Calculate Double-Time Pay

Here is the best way to calculate double-time pay:

1) Know the Regular Pay Rate: First, it’s essential to know your employees’ regular pay rate. This is the amount employees earn per hour for the standard work hours. It’s basically like the baseline salary for the time during a regular workday or workweek.

Here is the formula for the regular pay rate: Regular Pay = Regular Pay Rate x Regular Hours

2) Identify When Double Time Applies: Double time pay normally adds in under certain circumstances, like working on holidays and weekends or surpassing a certain number of hours in a single workday or workweek. Once employers tell employees they’re eligible for double time, they’re halfway there.

Here’s the formula for when double time is applied: DT Pay = (Regular Pay Rate x 2) x Any Time That Exceeds Regular Hours

3) Calculate Overtime Pay: Employers should know employees’ overtime pay before calculating double-time pay. Overtime pay is typically time and a half of the regular pay rate. So, if an employee’s regular pay rate is $10 per hour, then the overtime rate would be $15 per hour.

Effective cost management is paramount in construction projects to ensure financial viability and profitability. Utilizing construction cost control software enables employers to accurately track labor costs, including overtime pay, and overall project expenses. By having a clear understanding of overtime rates and other labor-related expenses, construction companies can better manage their budgets and avoid cost overruns.

4) Double Up the Overtime Rate: Once employers are done with the calculation, it’s time to double up that overtime rate to acquire the double-time pay rate. Keep in mind that double time directly means employers need to pay twice the employee’s regular rate. Thus, if their overtime rate is $15 per hour, their double-time rate would be $30 per hour.

5) Calculate the Double Time Earnings: After getting the double-time rate, it’s best to crunch the numbers. Just multiply the double-time rate by the number of hours employees worked at that rate. For instance, if an employee worked 3 hours at double-time, employers have to multiply $30 by 3 to offer $90.

6) Add It Up: Lastly, add the double-time earnings to any other earnings they’ve accumulated during that pay period—like regular pay, overtime pay, or any other bonuses or incentives. This gives them their total earnings for that period.

Thus, knowing the exact way to calculate the double-time Pay ensures employers offer the appropriate compensation employees deserve for their additional hours.

Also check: Free Workstatus timecard calculator

Simplifying Double-Time Pay Calculation with Workstatus

Financial managers can find it challenging to maintain overtime hours when paying employees for double-time pay. However, Workstatus’s user-friendly time-tracking and reporting features can simplify the whole procedure.

Here’s how Workstatus can help automate double-time pay calculation:

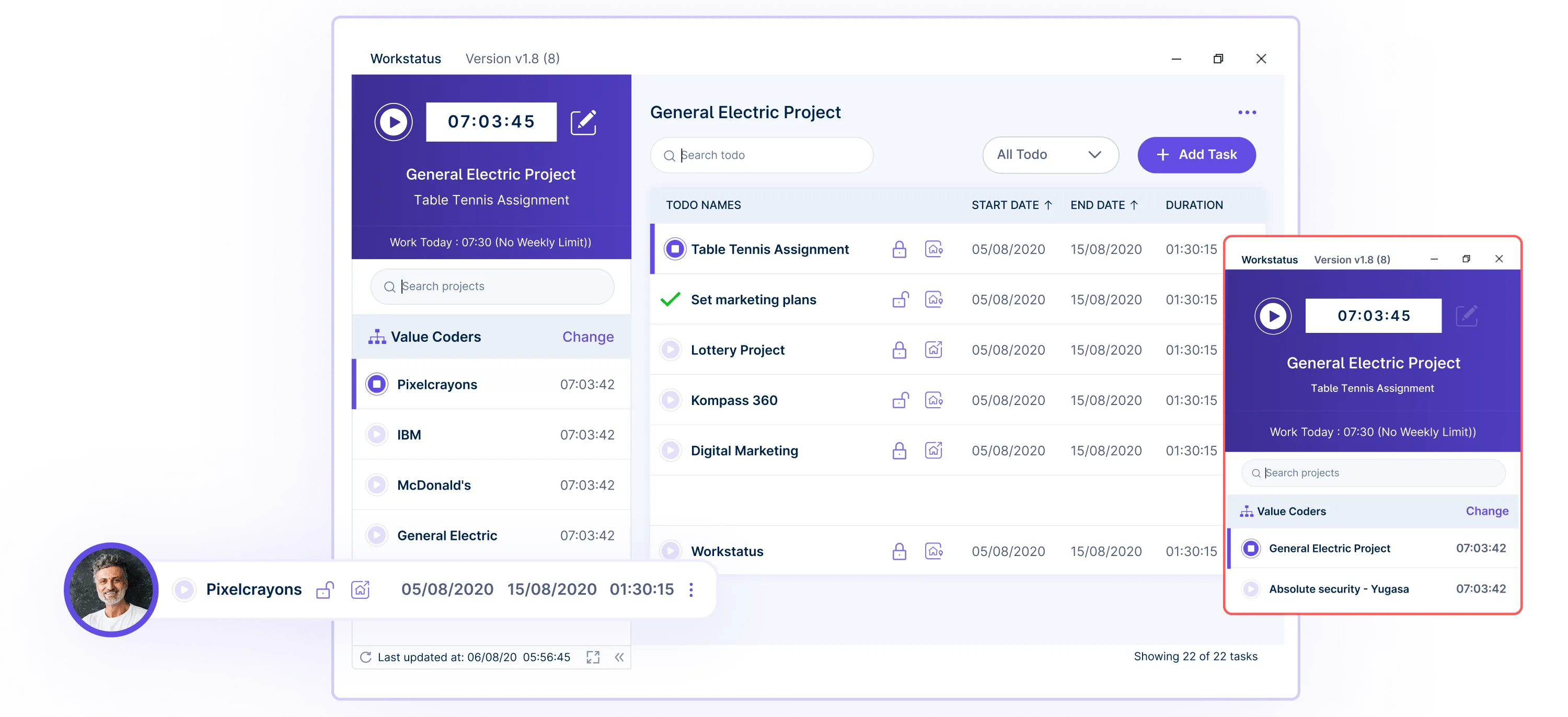

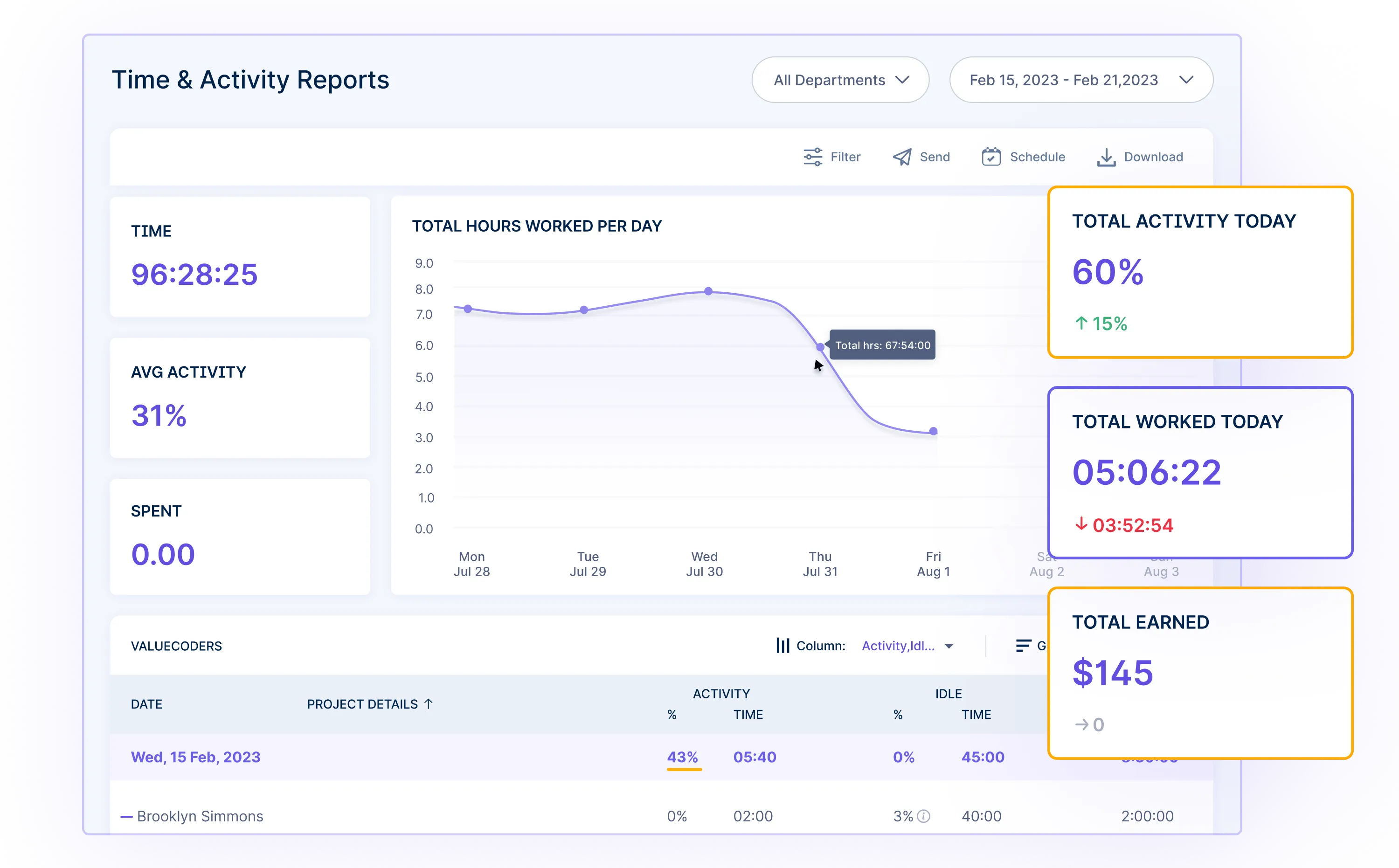

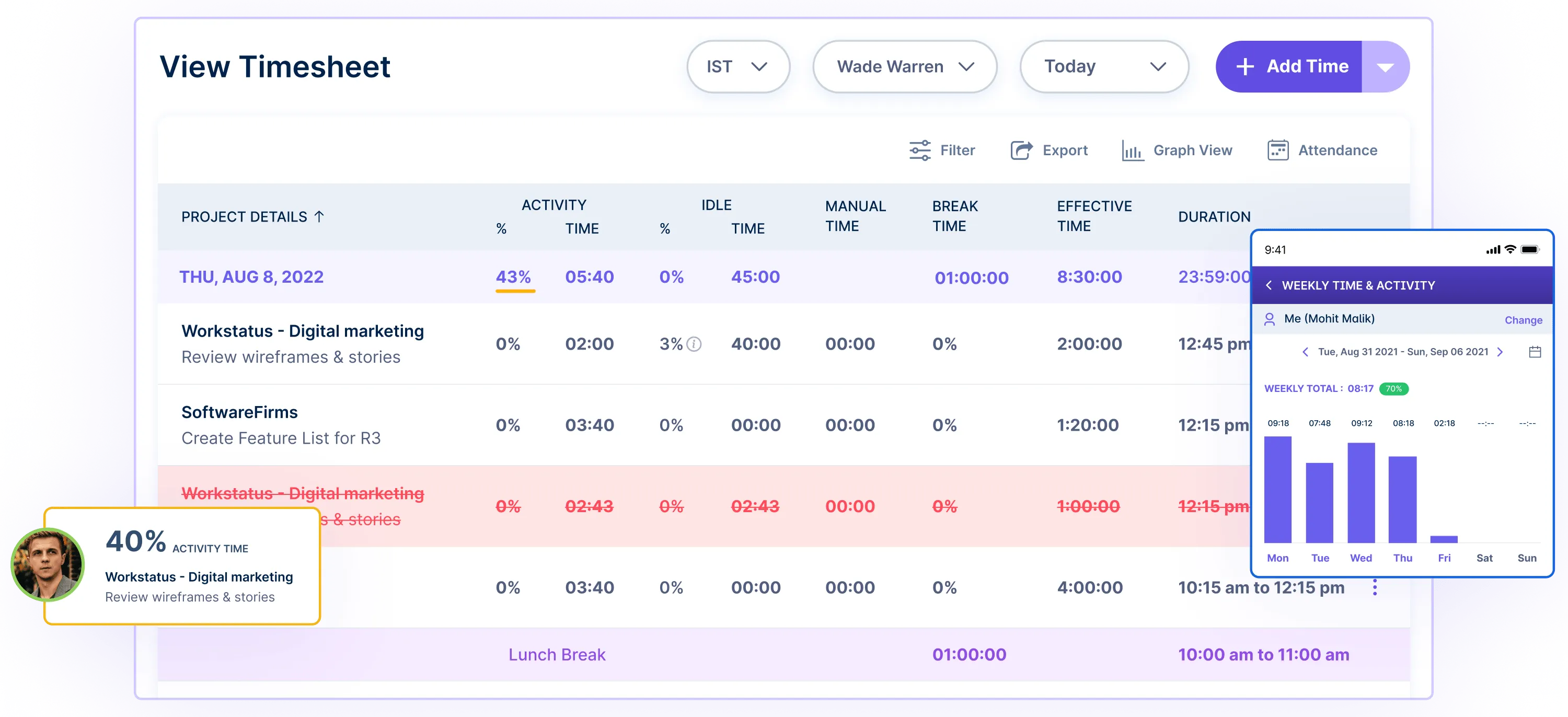

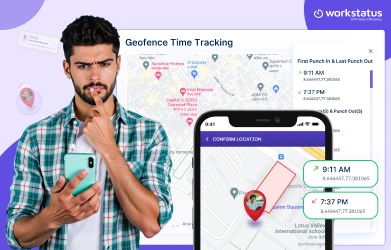

1) Accurate Time Tracking: Workstatus offers automated time tracking features that accurately record employee work hours, including regular hours, overtime, and double time. Employees can easily switch between tasks and projects while timing continues in the background.

2) Flexible Rates and Overtime Rules: With Workstatus, financial managers can set customized pay rates for different team members. These factors include hourly rates, overtime rates, and double-time rates based on the company’s policies. This flexibility allows for easy adjustment to comply with double-time pay regulations, and company policies.

3) Insights into Work Hour Trends: Workstatus offers reliable insights into hourly trends and overtime. It allows managers to review work-hours spikes and enquire about projects or daily analytics.

4) Automatic Flagging of Double Time: Workstatus can automatically flag overtime hours beyond 40/week or 8/days. As a result, double-time hours are directly marked for easy identification and seamless payment processing.

5) Timesheet Reviews and Approvals: By using Workstatus, managers can check timesheets before locking them. They can observe the accuracy of double-time hours worked before approving the payroll.

6) Seamless Payroll Integration: After approval, timesheets are exported to leading payroll systems such as Gusto HR Software, QuickBooks, ADP, and more for accurate and timely pay processing.

By employing these prominent features, calculating double-time pay becomes easier, more accurate, and compliant for businesses. The reliable reporting avoids any manual calculator errors. All in all, Workstatus can minimize payroll processing time by over 60% every period.

Compliance with Double-Time Pay Regulations

By following these simple steps, employers and employees can ensure compliance with double-time pay regulations and avoid potential penalties or legal issues:

1) Understand the Rules: Compliance with double-time regular pay begins after employees know the rules. Labor laws mostly define such rules. Employers must mention when double-time pay applies, the right way to calculate it, and the conditions under which they must offer it.

2) Maintain Accurate Records: Maintaining correct records of hours worked by employers and employees is imperative. Moreover, employers should keep detailed records of employee work hours, including regular hours, overtime hours, and double-time hours. Besides, employees should also track their hours to ensure they’re being compensated accurately.

3) Follow Company Policies: Many financial managers have policies concerning double-time pay, which may be more generous than legal requirements. Both employers and employees must understand and follow these policies to ensure compliance.

4) Communicate Clearly: Communication is essential to compliance with double-time pay regulations. Financial managers must directly communicate their policies concerning double-time pay to employees, including when it applies, how it’s calculated, and how employees can report any discrepancies in their pay.

5) Address Violations Promptly: If there are any violations of double-time pay regulations, they should be addressed promptly. Employers must investigate employee complaints or concerns regarding their pay and take appropriate action to remedy any violations.

6) Stay Informed & Updated: Typically, double-time pay regulations can change with time, so employers and employees must stay informed and updated on any new additions or changes to the law. It may also include attending training sessions, consulting legal experts, or adhering to industry publications and resources.

Remember, compliance is not just about following the law or rules—it’s about treating employees fairly and ensuring they’re compensated correctly for their hard work.

Double Time Pay vs. Overtime Pay

Read the below infographics to learn the difference between double-time pay and overtime pay:

Recent Developments and Future Trends

Some recent developments and future trends underscore the dynamic nature of overtime and double-time pay practices and the significance of being aware of evolving legal requirements, industry standards, and excellent practices in workforce management.

Today, employees’ rights advocates and labor unions constantly encourage fair compensation practices, like equitable overtime and double-time pay rates. It includes efforts to raise minimum wage levels, boost overtime protections, and ensure that all employees avail genuine compensation for their time and efforts.

Constant development in technology and automation has the potential to streamline time tracking and payroll procedures, making it quicker for employers to calculate and manage overtime and double-time pay correctly.

The prompt shift towards remote work has raised questions about correctly tracking and offering fair compensation to employees for overtime and double-time work done beyond normal office hours. As a result, some employers are exploring advanced technology solutions and flexible work policies to address these challenges efficiently.

Some economic factors, like inflation, unemployment rates, and workforce shortages, can directly impact employers’ decisions concerning double-time pay. Employers may adjust their compensation practices during the economic uncertainty phase to stay competitive and attract top talent.

However, such developments also initiate concerns about data privacy, algorithmic bias, and the potential for wage theft if not employed responsibly. Still, employers and policymakers must stay vigilant in addressing emerging issues and ensuring that workers get fair compensation for their time and efforts.

Closing Thoughts

In conclusion, double-time pay is a token of respect by employers for employee’s time and effort, a tangible acknowledgment that their commitment is valued and worthy of recognition.

Managing the complexities of double-time pay requires a detailed understanding of its meaning, calculation methods, applications, and compliance with the law. Thus, calculating double-time pay does not have to be challenging for businesses.

By following the best practices, employers can offer experience fair and transparent compensation systems, eventually promoting a harmonious work environment and building mutual trust between employers and their workforce.

With the right tools, direct communication, and mutual trust, businesses can control the work hours of different employees and learn to run payroll like a professional.